Latest Posts

Great Recession Headed for Greater Depression-Michael Pento

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Money manager Michael Pento says don’t believe the Fed when it says “the economy is doing well.” It’s not. Pento explains, “As long as the stock market continues to go up, the Fed is going to continue to slowly raise interest rates. So, when the inevitable collapse occurs, and that’s what the Fed does, the Fed is in the business of lowering interest rates, creating asset bubbles, which pile up the level of debt, then raising rates and collapsing the economy. That’s their mantra. That’s their MO (modus operandi) and it has happened over and over again. (more…)

Somebody is Lying About Spying, Fed Hikes Rates & Gold Spikes, War Update

By Greg Hunter’s USAWatchdog.com (WNW 276 3.17.17)

By Greg Hunter’s USAWatchdog.com (WNW 276 3.17.17)

Somebody is lying about spying on Donald Trump. The Senate says they see “no evidence,” and yet the New York Times runs a story about revealing information that came from “wiretapping Trump aides.” Respected Judge Andrew Napolitano says British Intelligence did the spying because it has 24/7 access to NSA records. The British Spy agency denies this charged. Bottom line, The Trump Administration is overtly and covertly under attack, and that is clear. Expect a counterattack and soon from the Trump camp.

America in Totally Unknown Territory-Scott Uehlinger

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former CIA Station Chief Scott Uehlinger says the 2016 Presidential Election put “America in totally unknown territory.” Uehlinger explains, “I lived in countries like Azerbaijan, Moldova and Kosovo. These were rough and tumble places where this was my bread and butter. There was always a Prime Minister or a head of state that was using intelligence services to embarrass or frame or destroy members of the opposition party. This is something I have seen time and time again. This is something I have had to collect intelligence on time and time and time again, and I think this kind of gives me a unique perspective into what is going on in the United States right now. I have seen this all before, but we also have to remember that this has never been here before. This is something new for Americans and, unfortunately, it’s not really new for me.

Trump Needs a War Team-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former Assistant Secretary of Housing and financial advisor Catherine Austin Fitts says the Trump Administration is at the beginning of a long war against his deep state enemies. Fitts recommends, “I don’t think it’s an accident that WikiLeaks dumps out documents proving that the CIA has the capacity to do a hack and make it look like the Russians. So, what we are watching are war games. This is like chess. You try to take out the lieutenants before you take out the queen. . . . My guess is you have very significant capacity on the Democrat side, literally hundreds of people and law firms doing surveillance and intelligence, and figuring out how they can weaken the Trump team. Now, what we see coming back the other way, including the WikiLeaks dumps, there is clearly capacity on the other side. (more…)

Deep State Treason Against Trump, Rate Hike Disaster, Troops Sent to Iraq

By Greg Hunter’s USAWatchdog.com (WNW 275 3.10.17)

By Greg Hunter’s USAWatchdog.com (WNW 275 3.10.17)

The story of Trump colluding with the Russians prior to Election Day has now been totally discredited along with the Democrats, mainstream media (MSM) and rogue members of the intelligence agencies. The story has morphed into felony leaks to try to destroy Donald Trump. It has revealed police state tactics from an outgoing party to an incoming party. Did the White House know about the wiretapping of the Trump campaign? Are the leakers inside the Intel agencies going to be charged with felonies for the leaking of information to try to destroy Trump? Can the MSM ever recover from their unfair and fake news reporting? The answers will be coming in the weeks and months ahead, and Donald Trump will be getting the last laugh.

Noah’s Flood of Cash Coming-Hugo Salinas Price

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Mexican billionaire and retail magnate Hugo Salinas Price is a big proponent of using silver as money in Mexico. Salinas Price explains, “The idea is not to go back to a silver standard, but to create a parallel currency which would be a monetized silver coin. It would not bear a stamped value. It would be a plain silver coin with a quoted value given to it. This value would be adjusted upward with a fall in the value of the peso or a rise with the price of silver.”

The Deep State is Dying-Clif High

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Internet data mining expert Clif High says the world is witnessing the unmasking of the so-called “Deep State” and revealing it’s long held control over humanity. High explains, “The level of complexity of humans has increased, and that was the factor that the Deep State did not take into account. They kept their rigid mindset, their rigid rules, their compartmentalization and kept everything so boxed in even they were unaware that humanity has evolved out and around their obstruction. So, the Deep State is dying simply because the knowledge of it is so prevalent. It can’t be stopped, and is growing exponentially, and, basically, the knowledge itself is going to crush the Deep State.”

Fake Russia/Sessions Story, Obama Plotting Against Trump, Fed Rate Hike

By Greg Hunter’s USAWatchdog.com (WNW 274 3.3.17)

By Greg Hunter’s USAWatchdog.com (WNW 274 3.3.17)

New Attorney General Jeff Sessions is under fire in the ongoing fake story about Russian involvement in the 2016 election. It centers on his old job as a senior member of the Armed Services Committee in the U.S. Senate. Sessions was asked if he had contact with Russian officials about the election. Sessions said, “No.” Sessions did talk to the Russian Ambassador as part of his duties in the Senate. Now, Sessions has recused himself in the ongoing Russian hacking investigation where no evidence has come forth about the Russian government having an effect on the outcome of the 2016 election.

Crack-up Boom Here Now-Rob Kirby

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Macroeconomic researcher Rod Kirby thinks the world is well on its way to much higher inflation. Kirby explains, “Some people say there is a dollar shortage in the world. I do not believe there is a dollar shortage. I think we are seeing evidence that there are too many dollars in the world, not too few. Look at real estate prices around the world. In Canada, they are at record levels. In America, they are at record levels. Real estate prices are at record levels in Britain. There are record levels in Australia. They are at record levels in China. This is not what you’d expect in an environment where there are too few dollars. We are seeing the equity markets rally day after day and make new all-time highs. These are not the kinds of things you see when there are too few dollars. In my view, this might be the thin edge of the wedge of a crack-up boom. Money is getting to the street because money is being taken out of dark pools on the dark side of the U.S. Treasury and is being injected into the market place as bonds are being sold off and redeemed. The world is flush with money, extremely flush with money.”

Giant Fiscal Bloodbath Coming Soon-David Stockman

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former Reagan Administration White House Budget Director David Stockman says financial pain is a mathematical certainty. Stockman explains, “I think we are likely to have more of a fiscal bloodbath rather than fiscal stimulus. Unfortunately for Donald Trump, not only did the public vote the establishment out, they left on his doorstep the inheritance of 30 years of debt build-up and a fiscal policy that’s been really reckless in the extreme. People would like to think he’s the second coming of Ronald Reagan and we are going to have morning in America. Unfortunately, I don’t think it looks that promising because Trump is inheriting a mess that pales into insignificance what we had to deal with in January of 1981 when I joined the Reagan White House as Budget Director.”

MSM Lies about Illegal Aliens, Most Americans Don’t Want Illegals, Trump Trapped-Gold Will Soar

By Greg Hunter’s USAWatchdog.com (WNW 273)

By Greg Hunter’s USAWatchdog.com (WNW 273)

The mainstream media (MSM) are being exposed for the propaganda press it is. Trump has new guidelines to enforce immigration laws and deport people who are illegally here, and yet the MSM calls them “undocumented” or simply “immigrants.” The MSM will not use the term “illegal immigrant” or “illegal alien” because it destroys the false narrative and would reinforce the idea that people break the law to come to America. Democrats and their lap dog propaganda press want illegals from foreign countries to undermine the legitimate citizens and their wants and needs.

Weather Warfare Biggest Threat to Life on Earth-Dane Wigington

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Geoengineering researcher Dane Wigington says the number one threat facing humanity is extreme weather modification to cool the planet. It’s being done by geoengineering (commonly known as chemtrails) and it must be stopped now because it’s having the opposite effect. Wigington says all climate engineering is really just “weather warfare” and explains, “How long can humans survive without habitat? If we have an issue that is mathematically the greatest single assault launched by the human race against earth’s natural life support system, why wouldn’t we deal with that first and foremost above anything else?”

Trump Destroys Very Fake News, NSA Leaks on Trump the Real Story, Fed Scared to Death

By Greg Hunter’s USAWatchdog.com (WNW 272 2.17.17)

By Greg Hunter’s USAWatchdog.com (WNW 272 2.17.17)

The mainstream media (MSM) is in an absolute frenzy over the resignation of Michael Flynn, who was the top national security advisor for the Trump Administration. President Trump says Flynn was forced out because of illegal leaks. In a press conference, Trump told the national media that it was “dishonest” and that CNN’s new name is now “very fake news” instead of simply “fake news.” Trump also said the MSM is “full of hatred” and is biased against him and his administration. Former U.N. Ambassador Michael Bolton says the left is “engaging in collective hysteria because it cannot make substantive arguments” against Trump and his new policies.

Definite Movement to Take Trump Out-Gerald Celente

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trends forecaster Gerald Celente says the resignation of top security advisor Michael Flynn is further proof there is an ongoing “destabilization campaign” and a “definite movement to take out Trump.” Celente explains, “When Trump came in, one of the first things he said in his campaign is let’s stop this fighting with Russia, they’re not the threat that everyone says they are. Since he’s been saying that, he’s been attacked. Let’s go back to Michael Flynn. Trump and Flynn say the CIA has become too politicized. A lot of these agencies have been wasting money and giving us bad information. That was what a lot of Flynn was about. Let’s not forget that Obama dumped Flynn because those were the things that Flynn was saying that Obama didn’t want to hear.”

Empire Strikes Back on Trump-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

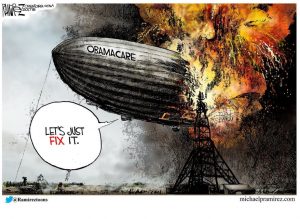

Investment advisor Catherine Austin Fitts says the oligarch, or establishment class, is on the attack. She calls this latest chapter in the Trump Administration “The Empire Strikes Back.” Fitts explains, “Number one, Trump came into Washington with an agenda that would really make America great again: tax reform, regulatory relief, infrastructure and Obama Care. Immediately, he got bogged down in those for a variety of reasons. If you look at Congress’s constituents, they can’t make money solving those things, particularly if it helps regular people. (more…)