Latest Posts

US & Clinton Beyond the Law-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial expert and former Assistant Secretary of Housing, Catherine Austin Fitts, says the U.S. government’s actions with Hillary Clinton means it is more lawless than ever. Fitts explains, “The entire country now looks like Arkansas . . . we’ve all turned into Mena, Arkansas, now. It’s pretty tragic. I have watched for two decades while 80% of the federal budget and federal credit has been run outside the Constitution and the laws related to financial management. I have never seen anything as blatant and outrageous as Loretta Lynch, prior to Hillary Clinton’s interview with the FBI, meeting with her disbarred husband, who is either the husband of or the target of a criminal investigation, and basically briefing him, I am assuming and what I believe on what Hillary needs to know, so she can skate the (FBI) interview. What the President, Lynch and Comey don’t want is the investigative team recommending to indict. . . . If you know anything about civil or criminal procedures, this is so beyond the law. This is so over the top that I have never seen anything more outrageous. It’s beginning to look like Mena, Arkansas, during the Mena drug running.”

More Islamic Terror in France, Black Lives Matter is False Narrative, Phony Stock Market Highs

By Greg Hunter’s USAWatchdog.com (WNW 246 7.15.16)

By Greg Hunter’s USAWatchdog.com (WNW 246 7.15.16)

France has been hit once again by Islamic terror–this time in Nice. The French Riviera town was struck during Bastille Day celebrations by a terrorist who used a truck to mow down dozens of people. French media says ISIS is claiming responsibility for the heinous crime.

Global Economy Critical Condition Code Blue-Rob Kirby

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Macroeconomic analyst Rob Kirby says don’t trust the stock market’s rise to new all-time highs. The global economy is in terminal trouble, and Kirby explains, “My view of the financial system as it sits today is we are in an intensive care unit, and we have a lot of tubes and wires connected to us right now. The question you are asking me is how long is a person in critical condition in an intensive care unit going to live? I don’t really know the answer to it other than we could get a code blue any day. We could get a code blue tomorrow . . . code blue is when somebody has passed.”

Separate Laws for Political Nobility & Economic Elite-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday release)

By Greg Hunter’s USAWatchdog.com (Early Sunday release)

Trends researcher Gerald Celente says Hillary Clinton not being charged by the FBI for having a private unprotected email server is just a small part of an ongoing major trend. Celente explains, “It’s bigger than Clinton. It’s a trend, and anybody can see it if they open their minds and add up the facts. What we have now is a neo-feudal society. It’s all connected. It’s, as we call it, ‘global-nomic.’ Since Obama became President, and these are the facts, 95% of the wealth since 2009 has gone to the 1%. Now, let’s take a trip around the world. 62 people have more dough than half of the world’s population combined. In the United States, 400 people are worth $2.5 trillion. What I am saying is the word ‘justice’ is being misspelled. It’s J U S T U S—Just Us. . . . You have separate laws for the political nobility and the economic elite.”

No Charges for Clinton Proves Two Tier Legal System, Global Crash is Certain, Buy Gold and Silver

By Greg Hunter’s USAWatchdog.com (WNW 245 7.8.16)

By Greg Hunter’s USAWatchdog.com (WNW 245 7.8.16)

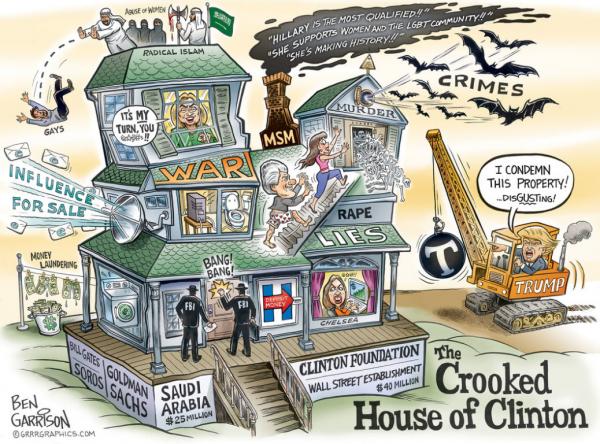

You’ve heard by now, Democratic presumptive nominee Hillary Clinton will not be charged over her unprotected email servers she used while at the State Department. Even though FBI Director James Comey pointed out multiple lies Ms. Clinton told, he decided not to recommend charges and said he “could not prove intent.” He also explained his decision to Congress this week but would not comment when asked about other investigations into the Clinton Foundation. Comey revealed that he did not personally interview Ms. Clinton last Saturday or even attend the deposition. He also revealed that Clinton did not testify under oath. (more…)

Collapse of Empires is Upon Us-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader and analyst Gregory Mannarino says what is going on today with the FBI refusing to indict Hillary Clinton is nothing new when considering the “fall of empires.” Mannarino explains, “This is a cycle, and we are seeing several pieces fall into place regarding the political system and the financial system that we have seen over and over again. There is a lifespan of an empire . . . at the top of every empire . . . there is an issue of the financial system, and there is an issue with the political system that becomes absolutely corrupt. This is why this announcement (FBI not indicting Clinton) came. Again, this is political corruption. It’s not just here in the United States, but globally it is flashing red across the sky. . . . I think they are well aware that the whole system is going down. The collapse of empires is upon us. . . . We are in an environment that globally we have never seen before. With what we are seeing in the United States with the corruption in politics, we’ve seen that before. Every great empire, right at the top, the two key elements that appear are financial system on the edge and political corruption trying to patch it all together. That is something we see over and over again throughout history.”

Disintegration & Overthrow of Global Elite Regime-Michael Krieger

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former Wall Street analyst and journalist Michael Krieger contends the recent so-called “Brexit” chaos is signaling something much bigger than coming economic trouble. Krieger explains, “I think the biggest thing with Brexit, and I think it is far bigger than an economic downturn, is the disintegration and ultimately the overthrow of the entire status quo regime, the entire post WWII establishment. That’s way bigger than an economic decline. It’s way bigger than the economic decline in 2008 and 2009. When you think about it, since 1945, we’ve had all kinds of economic declines. We’ve had bear markets and bull markets, but the status quo, the establishment, the basic principles that have been guiding the world for, let’s say 80 years now, those are what are going to be overthrown, and that is a way bigger deal than an economic downturn, in my opinion.”

Clinton-Lynch Airport Meeting, Gun Running to Terrorists and the Most Systemically Dangerous Bank

By Greg Hunter’s USAWatchdog.com (WNW 244 7.1.16)

By Greg Hunter’s USAWatchdog.com (WNW 244 7.1.16)

Attorney General Loretta Lynch, along with the FBI, is investigating the biggest political scandal in American history with Presidential presumptive nominee Hillary Clinton. Allegations include: a private server that jeopardized national security, charity fraud and bribes paid in donations for favors from Clinton while she was Secretary of State. Against that backdrop, Lynch took a private meeting with Mrs. Clinton’s husband, former President Bill Clinton, on Lynch’s private jet in Phoenix. We are supposed to believe this was a chance meeting, and we are also supposed to believe they talked about golf and grand babies. That is preposterous, and I think somebody called a meeting. It was so important that Lynch put her reputation and credibility on the line. This was a powerful meeting, and it is impossible to believe that they talked about grand babies and golf when the most explosive political case in U.S. history hangs in the balance in an ongoing FBI criminal investigation.

Brexit is the Match that Ignites the Powder Keg-Peter Schiff

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

Money manager Peter Schiff says don’t believe the so-called “Brexit” was the real cause of the recent chaos in the financial markets. Schiff explains, “If the global financial system and the markets were healthy, ‘Brexit’ would be a non-event. I mean what difference does it make in the scheme of things if the UK is not part of the EU? In a healthy economy, it would just shrug it off, but because we have anything else but a healthy financial system, it’s all a gigantic bubble. It’s a house of cards. That’s how fragile it is, and it’s all propped up with cheap money, negative interest rates and quantitative easing. Everybody is confident that the central banks and politicians can keep these bubbles in the air that they are juggling. Now, all of a sudden, something goes wrong that they didn’t expect. It shows that the government is losing control, and this is the wake-up call. This is what has everybody so scared. This is the match that ignites the powder keg, but the powder keg was there all along.”

Crash of All Crashes Coming-Bo Polny

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Market cycle analyst Bo Polny says the vote by the UK (Brexit) to leave the European Union is a big turning point. Polny says, “Brexit is England and part of the cycle and I believe looks to be the actual trigger that is going to take gold higher and the trigger that is going to cause the world equity markets to collapse. It looks like it started, but we will have a little bit of time yet before things get extremely crazy. We are not going to get out of June before all heck breaks loose.”

Special Report on Brexit/Fantasy Meets Reality

By Greg Hunter’s USAWatchdog.com (Addendum to the WNW )

By Greg Hunter’s USAWatchdog.com (Addendum to the WNW )

Do not believe the mainstream media that the Brexit vote crashed the global markets. The real reason why all markets tanked is record debt levels around the world that will never be paid back. Fantasy has just met reality in the global markets, and the carnage is far from over. The fantasy of unpayable debt expanding forever is now beginning to be realized by the central banks that have been propping up the global economy since the 2008 meltdown. The central banks cannot and will not be able to stop this unfolding crash. If you are not prepared, there is little time left. (more…)

MSM Trump Fact Checking Totally Unfair, No Recovery Economic Update, US, Russia, China, War

By Greg Hunter’s USAWatchdog.com (WNW 243 6.24.16)

The mainstream media (MSM) calls their latest unfair coverage of Presidential GOP presumptive nominee Donald Trump “fact checking.” In reality, it’s a way for the MSM to hide the fact it is unobjective, totally unfair, and only out to destroy Trump in favor of the candidate and party they’re in the tank for, Democrat Hillary Clinton. The only candidate the MSM is “fact checking” is Trump. Meanwhile, every week, there is a new angle to the Clinton private server scandal, or her so-called charity, the Clinton Foundation, which some say is a huge charity fraud, or allegations of influence peddling while she was Secretary of State in the first Obama Administration. There are no teams of reporters and producers on this ongoing story. There is only “fact checking” by the clearly biased MSM on the candidate and party they hate.

Massive Defaults & Dramatic Increase in Gold-Nick Barisheff

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Gold expert Nick Barisheff wrote a book titled “$10,000 Gold” in 2013. According to Barisheff, that number is even more possible today. Barisheff contends, “It’s hard to believe when I wrote the book three years ago, and I talked about the issues that would lead to $10,000 gold are still there and have gotten much worse. None of the issues have been solved, and now we are in multiple bubbles, a lot of them surrounding debt, and it keeps growing all over the world, and that’s the main correlation to the price of gold.”

Jim Sinclair-Next Crash Will Look Like Mad Max

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Renowned gold and financial expert Jim Sinclair says recent dire predictions from Wall Street icons are more than a warning. They are telegraphing their trading positions. Sinclair explains, “They are preparing for what they believe. They talk their own positions. So, it’s more than a warning. They are telling you exactly what they have done. They are not out to save the man in the street. They are out to make money in a huge short position, probably in over-the-counter derivatives. . . . They’re not looking for a market tic down. They are looking for a market with a character of backing up to an open to an elevator with no elevator there. . . . We’ve got no volume, fake prices, and we’ve got the biggest money in the world short the market. We’ve also got a Fed with no tools, and now we have a Fed whose primary indicator is starting to have a heart attack. . . . When this thing comes down, it’s going to be a free fall.”

Dems Disarm America in Face of Terror, Economy Bad to Worse, Trump Fights MSM

By Greg Hunter’s USAWatchdog.com (WNW 242, 6.17.16)

By Greg Hunter’s USAWatchdog.com (WNW 242, 6.17.16)

There is no wonder why Democrats want to talk about gun control. The Islamic terror is increasing, and the Democrats provide lip service. Now, the Democrats want to disarm America in the face of rising violence from radical Islam. The Obama Administration would like you to believe that these terrorists are “self-radicalized.” In many cases, that is not the true story. There is a percentage of mosques in the U.S., according to the FBI, that teach and encourage violence and jihad. According to several different whistleblowers and reports, the Obama Administration has been shutting down investigations into radical Islam and, in some cases, scrubbing suspected terrorists from data bases. President Obama has repeatedly said that ISIS is on “defense,” but his own CIA director, John Brennan, said in Congress, this week, ISIS is “formidable and resilient.” Brennan warns that ISIS is not only training more fighters to attack America, but ISIS will likely get into the country posing as refugees from Syria.