Latest Posts

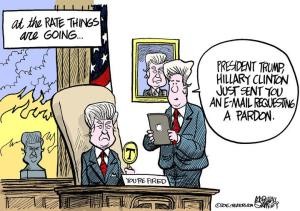

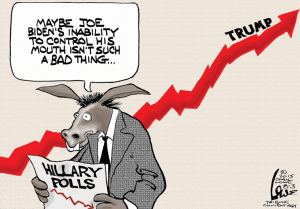

Market Pre-Crash, China Bumps US Debt, Biden Better than Hillary, Dems for Iran Deal

By Greg Hunter’s USAWatchdog.com (WNW 205 8.28.15)

By Greg Hunter’s USAWatchdog.com (WNW 205 8.28.15)

To say the stock market was on a roller-coaster ride this week is an understatement. Already, some are saying this action is just a blip. They say it’s a buying opportunity. They say it’s a correction and nothing more. My sources say none of that is true, that this is just the warm-up act of a much bigger downturn. Charles Nenner told me this is just the pre-crash. The big crash is coming. Gregory Mannarino of TradersChoice.net, who called the top in this market more than 2,000 points ago, says market crashes are not a one and done event but a process. He says the 2008 meltdown started in September and didn’t finish until March of 2009. It only ended with massive QE and money printing and suspension of accounting rules by FASB. Fast forward to today, and we have reports of China selling U.S. debt (Treasuries) because China’s markets are in turmoil. In simple terms, they need the cash to try to stabilize their markets. ZeroHedge.com is reporting that when China sells Treasuries, it is really QE or money printing in reverse. It is reported that if China sells enough Treasuries, it could spike interest rates. Funny, former Fed Head Alan Greenspan also recently warned that a bond bubble could explode and spike interest rates. What happens if every other country sells a chunk of the more than $16 trillion of liquid U.S. government debt all at the same time? This is the scenario economist John Williams has been warning against and will be here for an update next week.

Plunge Protection Team Losing Control of Markets-Jim Sinclair

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Legendary gold expert Jim Sinclair says what is going on right now in the stock market is just the warm-up act. Sinclair contends, “This is a pre-crash, and we are not making it through September without the real thing. Everybody is on credit. Main Street is on credit. This seems to be a bubble of historical proportion when it comes to the amount of money supporting the accepted lifestyles as being the new normal. Raising interest rates is impossible today. The market is so fragile. Nothing can come out that causes people any concern or derivatives any change, nothing whatsoever. We are going through a period of time where expecting nothing meaningful is a dream. These are times never experienced in financial history. . . .It is very possible that we are going to have a super civilization change. ”

Global Crash Will Force More Money Printing-Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Top trends researcher Gerald Celente has recently predicted a market crash between now and the end of the year. It looks like that prediction is unfolding now, and Celente contends, “It’s very simple. You have a global slowdown, and this is after central banks have pumped in trillions of dollars, yen, yuan, euros and you name it to propping it up. We are in unprecedented territory. This has never happened before in the history of the world. . . . Even the Wall Street Journal came out last week with a front page story and said the Fed used up all its ammunition. They have nothing left to do because they have record low interest rates, but I disagree with them. I believe they will come out with another round of quantitative easing (QE or money printing). They will do anything they can. It looks pretty sure they are not going to raise interest rates in September. . . . What is going to create jobs? The jobs they are creating stink. Here’s a number for you. Medium household income is 6% below where it was in 1990. Look at the new home buyers. In good times, first time buyers are usually around 40%. It is down to 28%. Look at the amount of people who own homes. It’s back to 1960 levels. Look at the labor force participation rate. It is back to late 1970’s levels. There is no recovery. It’s been a cover-up.”

Hillary in Deep Trouble, Iran Nuke Side Deal, Economic Warnings

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

(WNW 204 8.21.15)

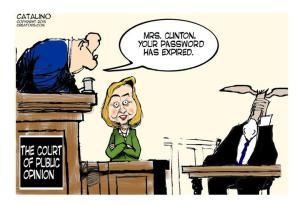

Hillary Clinton’s email troubles keep getting worse. It is reported that national security laws were broken by Clinton and at least two of her staff. More that 300 of her emails have now been deemed classified and allegedly mishandled. Clinton turned over her server to the FBI and says she doesn’t know who wiped it clean. It is also reported that two of Clinton’s top aides have disregarded a federal judge’s order to make sworn statements that all government documents in their possession have been turned over. Every day, this email scandal is getting worse. As I said months ago, Hillary Clinton will not be President, and it will not be the Republicans that pull the plug on Hill’s Presidential run, it will be the Democrats. Democrats have to be worried because this is looking like it is turning into a full blown crime and cover-up. At some point, the Dems will replace her, and they are not going to wait until a few months before the election. I think Hillary will be out before the first debate.

Beginning of a Breakdown in International Trade-Hugo Salinas Price

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Mexican business magnate Hugo Salinas Price says that there are “many more” devaluations coming for China’s currency. Salinas Price thinks that many other countries will cut the value of their currencies because the world economy is in deep trouble. Salinas Price contends, “When China does this, that is very serious. Already, the United States is receiving huge quantities of Chinese goods. It has an enormous trade deficit with China, and now that they devalued, it’s going to get worse. There is going to have to be a corresponding move on the part of the United States. . . . This is going to be the beginning of a breakdown in international trade. Is the United States going to stand by because China continues to devalue? How much has the Chinese currency been devalued, not even 8%. That’s not going to help the Chinese much. When you have a devaluation, it has to be about 40%. Then it really has teeth in it. I think the Chinese will continue to devalue.”

Debt Problem Will Swallow the Earth-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer and trader Gregory Mannarino predicts that big debt defaults are coming. Mannarino contends, “We are starting to see this with Greece and Puerto Rico here. It’s everywhere. This is a global problem and it’s going to engulf the world. This debt problem is going to swallow the earth. They have done this on purpose. They cannot be this stupid. . . . They are doing this on purpose and there is going to be no soft landing. It is a global issue and it is going to implode.”

Hillary Clinton Email Trouble, China Devalues Yuan, No Iran Deal Kills Dollar says Kerry

By Greg Hunter’s USAWatchdog.com (WNW 203, 8/14/15)

By Greg Hunter’s USAWatchdog.com (WNW 203, 8/14/15)

Hillary Clinton is in big trouble with her private server and how classified and “Top Secret” documents were handled. It is reported she turned over her private server to the FBI, and it is also reported it was professionally wiped clean. She was legally required to keep it intact. ABC News is reporting she got tips on “How to delete something so it stays deleted.” Wiping the server clean is not going to save her from a huge and growing legal mess. It is already known that Top Secret documents were not handled correctly, and that even the words “Top Secret” were removed when sending some emails from the State Department to Clinton’s private server. This happened while the Democratic front runner ran the State Department. This story is not going to go away, and now people are openly calling her a criminal and calling for a Special Prosecutor. This is not just Mrs. Clinton, but also her staff are being implicated in alleged national security breaches and outright crime to cover it up. Clinton maintains she has done nothing wrong. There are numerous allegations of criminal acts and conspiracy that is surrounding this growing scandal. (more…)

China Just Turned the Currency War Nuclear-Andy Hoffman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer Andy Hoffman wrote an article titled “Upcoming, Cataclysmic, financial Big Bang to End all Big Bangs,” and the very next day, China devalues its currency by a massive amount. What’s going on? Hoffman says, “A year from now, we are going to be 5% lower (on the yuan) not 2%. So, already the market is bidding down the yuan in what I believe must happen. For all the talk about bubbles here, the NASDAQ bubble, the debt bubble, the housing bubble, bubbles we see in Europe, the bubbles we see in Japan and, frankly, nothing even compares to China’s bubble both economically and financially because of what their communist government has wrought onto them. I think there are going to be further steps for China to devalue as their economy falls apart.”

The Ability to Prevent a Crash No Longer Exists -Bill Holter

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial writer and gold expert Bill Holter says the powers know that it physically can’t put off a financial crash much longer. Holter contends, “The system has gotten too big. The system has gotten bigger than the creators of the system, if you will. It is bigger than the sovereign governments collectively. It’s bigger than the central banks collectively. There’s too much debt. Too many sovereign governments have bumped up against debt saturation. In the U.S., we are over 100% debt to GDP. We are way over 100% debt to GDP if you include all debt. If you include all the off-book guarantees, Social Security, Medicare, Medicaid and all the other promises, we have blown up as far as debt to GDP ratios. So, the ability to prevent a crash no longer exists.”

Desperate Push for Nuke Deal, Economic Warning Signs, GOP Debate, California on Fire

By Greg Hunter’s USAWatchdog.com (WNW 202 8.7.15)

By Greg Hunter’s USAWatchdog.com (WNW 202 8.7.15)

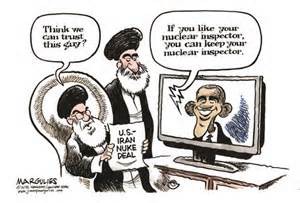

Congress is in recess, but that is not stopping President Obama to continue to push Democrats in both houses in Congress to vote yes in the deal to curtail Iran’s nuclear program. The President surely knows it will be voted down by the Republicans and many Democrats in the House and Senate. The only question: Will the President have enough votes to sustain a veto? It is a foregone conclusion that the deal will be voted down and the President will veto it. If his veto is not overridden, then the deal will go through. One big problem with getting the votes are the secret side deals that Iran has with UN inspectors. The other problem is that even unclassified information about the deal is not being released by the White House to the public. If it were such a great deal, why so secret, which is the same thing I said about the Republican sponsored secret trade deal called the Trans Pacific Partnership (TPP). It will all come down to a veto or a veto override.

Prolonged Gold Backwardation Has Never Happened in Monetary History-James Turk

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned gold expert James Turk says prolonged gold backwardation like we are seeing now, where the spot price is higher than the future price, has never happened before. Turk contends, “No, never, and I am a student of monetary history as well, and I have never seen it happen like this in monetary history. Typically, when a backwardation would occur under the classic gold standard, for example, the banks that would have fractional reserve banking would go under. There would be a banking collapse. So, typically, if there was a backwardation, it would only last for a few days as it did in 1999 and in 2008. So, we have an unusual situation where we have heavy government involvement where they are trying to keep the gold price under wraps so they can maintain this policy of zero interest rates. They are thinking they are going to jumpstart the economy, but the economy is not being jumpstarted. All it’s doing is deferring the ultimate collapse and the governments’ ability to repay all the debt that they owe.”

Vicious Out of Control Downturn Coming-Chris Martenson

By Greg Hunter’s USAWatchdog.com (Earl Sunday Release)

By Greg Hunter’s USAWatchdog.com (Earl Sunday Release)

Economic researcher and co-founder of Peak Prosperity, Dr. Chris Martenson, says, “Here’s where we are in the larger story. World economies can’t grow anymore, at least not like they used to. We are not going to see 3, 4 or 5 percent real growth. The pie is no longer expanding like it used to, and here’s the problem. The banking overlords got used to a certain take or lifestyle. . . . They became addicted to a certain amount of skim, and when everything is expanding, the banks can skim, and there is enough left over for things like middle class and 401ks to go up and pensions to be funded. When the economy is not growing fast enough, and the skimming continues, then there is not enough left over for other people. That’s where we are in the story. That’s step one. Step two is will the banks convert all of their loans into physical hard assets, and the answer is yes.”

French Contradict Kerry, Economy Update, South China Sea Tensions, Planned Parenthood Update

By Greg Hunter’s USAWatchdog.com WNW 201 (7/31/15)

By Greg Hunter’s USAWatchdog.com WNW 201 (7/31/15)

The deeper Congress digs into the deal to curb Iran’s nuclear ambitions, the worse the deal seems. When Secretary of State John Kerry, the key negotiator for the US in this deal, was asked about the secret side deals in Congress this week, he said he “did not have access to them.” What? You do not have access to details of a deal you negotiated? Kerry also says this deal must be passed by Congress, otherwise, he says, “our friends in this effort will desert us.” Now, details come out from a top French diplomat, who was also in on the negotiations, and he contradicts Kerry. French Senior diplomatic advisor Jacques Audibert has told Congress that if the deal is voted down, that eventually, they “could get a better deal.” When Kerry was asked about continued chants of “Death to America” in Iran, Kerry said he knew of “no plan to actually destroy us.”

Fed Most Certainly Will Not Raise Interest Rates—Paul Craig Roberts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former Assistant Treasury Secretary Dr. Paul Craig Roberts contends all talk of the Fed raising interest rates this fall is totally wrong. Roberts explains, “They most certainly are not going to raise them because they’ve spent seven years keeping them at zero. In fact, inflation aside, there are already negative interest rates. . . . So, they are most certainly not going to raise interest rates because if they raise the rates, they will destroy all their efforts to keep the big banks afloat. They also would destroy the stock market. What we have seen all these years is every time the market needs to correct, the Plunge Protection Team steps in and buys the Standard and Poor’s futures and drives the market back up. So, what would cause the Plunge Protection Team and the Federal Reserve to all of a sudden jettison the policies they have been following all these years to save the big banks, to save the stock market and to keep the aura of success alive in America?”

Geo Engineering Doing Most Destruction to Planet-Dane Wigington

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Dane Wigington, lead researcher for the global climate engineering informational website GeoengineeringWatch.org, says lawsuits are being prepared to get to the truth about what many call chemtrails. Wigington says, “It’s not just me. In fact, we have six US attorneys and two Canadian attorneys, and they are involved in this battle of their own accord because they realize their reality is disintegrating by the day. The climate engineering issue is the most significant environmental factor on the planet at this time. The filings are different in nature, and this will develop with their strategy. This is being done in a manner that will hopefully be a template for other states besides California to follow that template and also file suit. The heavy metal contamination is not arguable. It is there, and it’s not coming from China. It matches the climate engineering patents exactly. We have agencies whose job it is to disclose such a public health hazard and they are not disclosing, and there is liability from that –period. In the case of Northern California, we have spikes of aluminum in the Sacramento River, which is the drinking water for California, that is not being publicly acknowledged.”