Latest Posts

Magnitude of Correction Will Eclipse Them All-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader/analyst Gregory Mannarino says what is going on in the stock market is way worse than a so-called “correction.” Mannarino explains, “We are definitely going lower. Everything I look at, and there is a lot of material, is pointing lower. This is just the beginning. If we continue on the current trajectory, we are going to see a sell-off in this market that is going to spin people’s heads around. In my opinion, the party is over. There is going to be a terrible price to pay for financial misdeeds and irresponsibility by the Federal Reserve. . . . All they created is asset bubbles all over the place and inverse bubbles, meaning suppressed assets. This is going to correct to fair market value. It is a mathematical certainty, and there is no way out.”

Fed Scared to Raise Rates-Nomi Prins

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former top Wall Street banker Nomi Prins says forget about a Fed Rate Hike in December. It’s not going to happen. Prins explains, “They are not going to raise rates in December. I didn’t think they were going to raise rates in September. . . . It wouldn’t have made sense for that to happen, and it’s not going to make more sense for the same reasons for December. In the next three months, economies thought the world will not be repaired, markets will not be stable, currencies will not be stable, and all of a sudden, interest rates will not have the need to rise to hurt other countries who are reducing their rates. So, the Fed is not going to move in December. . . . The factors around the policies, around economy, around the markets, don’t lend themselves to doing that. So, she (Janet Yellen) is in a catch 22 of her making and of the Federal Reserve’s making. The choice was made to bail out the financial institutions and prop up the markets with artificial money, and printing money, and reducing the level of interest rates, and reducing the level of currencies relative to the dollar throughout the world. That was the decision that was made. . . . The talk is ‘we will see what the economy does. We’ll see if unemployment is better. We’ll see if inflation is still low, and then maybe we will think about it.’ That is all code for we are not going to think about it because we are scared to move and cause a worse situation than the one we already created. ”

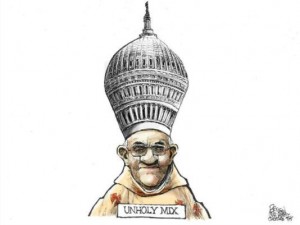

Politician Pope, China US Visit, Russia in Syria, Hillary’s Email Update

By Greg Hunter’s USAWatchdog.com (WNW 209 9.25.15)

By Greg Hunter’s USAWatchdog.com (WNW 209 9.25.15)

On his first visit to the U.S., the Pope is acting more like a left wing politician than a messenger of Christ. He has scolded Congress on everything from global warming to immigration. Most of his criticism is directed at Republicans though. There was not a single criticism given to the Castro regime in Cuba, and last I checked, their government is communist and atheist. I have been following the intense coverage and reading the Pope’s quotes, and I have yet to hear one public mention of Christ. I am a former Catholic that left the church after the pedophile priest scandal and the cover-up that went all the way to the Vatican. I like Catholics and have no problem with the main points of the Catholic Doctrine. The five main parts of the Catholic Doctrine are: Christ is the Son of God, Christ was born of the Virgin Mary, Christ died on the cross and shed his blood for the sins of the world, Christ rose again from the dead, and Christ will come again to judge the living and the dead. Please notice how ALL five major points of the Catholic Doctrine (which I totally agree with) are centered on Jesus Christ. While the Pope has mentioned God a few times in his public quotes, I have not heard a single quote that mentions the name of CHRIST. WHY?????? I don’t know if it is because the Pope just forgot to do so, or if he would like to see a one world religion, and of course there is no place for “God the Father and his Son Jesus Christ” in a one world religion. One thing is for sure, the omission of Christ’s name on an historic trip by the Pope this big is “too stupid to be stupid.”

Global Economy Imploding Now-Warren Pollock

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Warren Pollock warns the global economy is headed for a brick wall. Pollock explains, “It’s good you are using the term brick because that’s the part of the economy which is crashing first, the emerging markets, the BRICS (Brazil, Russia, India, China and South Africa). That’s on the edge of empire, and now it is imploding inward. So, we can look at all of these peripheral economies, and that’s where the crash has occurred right now. When you talk about crash and people asking, ‘When is this going to happen?’ It’s happening right now, but it is not happening at the center of empire, it’s happening on the extremities of empire. These emerging markets, these miracle economies, the few countries in the world that had productive economies, they’ve hit a brick wall. They’ve crashed. China has crashed. When you look at Brazil–crash. When you look at Russia–crash. When you look at oil prices–crashing now. People keep asking when is this blowing up? And the answer is it’s blowing up right before your eyes right now, this minute. The domestic indicator is the declining velocity of money.”

Fed Has Lost Control-Bill Holter

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial writer Bill Holter contends the recent announcement of the Federal Reserve not to raise rates means the “Fed has Lost Control.” Holter explains, “Whatever the Fed does is wrong. The reason I say that is because no matter what they do, they can’t fix what they have already done. There is no policy at this point that can repair where we are at this point as far as debt ratios, derivative outstanding and the money supply exploding. Nothing that they do now can fix it. The only thing that remains is a reset.”

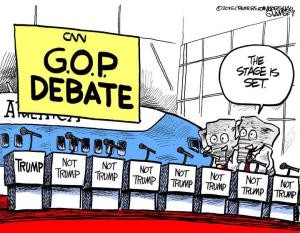

Fed Not Raising Interest Rates, CNN Big Loser in GOP Debate, GOP and DNC Fear Trump

By Greg Hunter’s USAWatchdog.com (WNW 208 9.18.15)

By Greg Hunter’s USAWatchdog.com (WNW 208 9.18.15)

The Federal Reserve is not raising interest rates, but now there are hints by Fed Head Janet Yellen that it might consider negative interest rates if the economy gets bad enough. The economy is already bad, and the Fed decision to keep a key rate near 0% says it all. I have been telling you for a couple of years that there is no real recovery on Main Street. The only real recovery is on Wall Street. Data point after data point shows the economy is not good. This is why the Fed is not raising interest rates. I wonder if the stories out this week in the mainstream media were nothing more than a huge psychological operation, or PSYOP. There were stories all over the place saying that a rate hike would “Not Likely Spook the Economy,” or an interest rate hike would be a “good thing.” Obviously, no rate hike is a much better thing, and now the Fed is hinting at negative interest rates if the economy gets bad enough. By the way, Gregory Mannarino of TradersChoice.net brought up the possibility of the Fed going to negative interest rates months ago. Mannarino also says the Fed decision NOT to raise rates shows that all is not well in the economy, and if the economy would be getting better, the Fed “would not need to continue emergency monetary policy of 0% rates.” He also says, “At some point, the dose becomes toxic and turns to poison and kills the patient.” He’s talking about the 80 months and counting of 0% interest rates, and remember, rates could be forced to go negative in the future.

Financial System Booby Trapped with Debt Bombs-David Stockman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former Reagan Administration budget director David Stockman says the biggest crash coming is not going to be in the stock market. Stockman warns, “I think we are headed for a central calamity. The central banks of the world have been on a 20 year campaign to massively expand their balance sheets and intrude into financial markets in ways that were never before imagined. In the process, they falsified every asset value there is from overnight money all the way to 30-year bonds and the stock market. Everything now is trading off the central banks, but the central banks have hit the end of the road. They have printed so much money and created such a massive global bubble that we are now in the process of that bubble fracturing. The central banks are now beginning to become confused and panicked about what to do. The Chinese have no idea what to do with their $28 trillion credit bubble and that house of cards in China. Our Fed is now on the verge of another meeting where they are debating if 80 months of 0% interest rates is enough. That is crazy.”

Global Economy is Imploding-Michael Pento

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Money manager Michael Pento thinks the global economy is terrible. So, will the Fed still raise rates soon? Pento contends, “The global currency situation will actually go into hyper-drive if the Fed follows through and goes on this protracted rate hiking campaign. Wall Street is a myriad and plethora of myths. . . . One myth that is out there today is the Federal Reserve may go and do a ‘one and done’ rate hike. Where has that ever been done before? Previous rate hikes have been about 300 basis points (or 3%). The last one was 425 basis points. . . . The Fed wants to be at 1.6% by the end of 2016. The only reason why they won’t get there, and I don’t think they ever will get there, is if the global economy continues to collapse. By the way, that is exactly what is happening. The global economy is imploding. Our clueless and feckless Federal Reserve is fighting inflation. . . . There is one area of inflation and that is asset prices. That’s where all the inflation has gone. The real battle is the global collapse of commodities. Commodity prices are at panic lows and even lower. We are having a global implosion of growth because China is no longer a sustainable communist regime.”

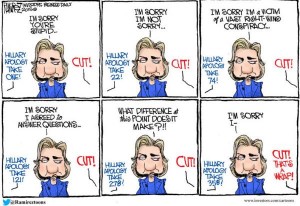

Dems Block Iran Nuke No Vote, Syria War Intensifies, Fed Rate Hike, Hillary in Deeper Trouble

By Greg Hunter’s USAWatchdog.com WNW 207 9.11.15

By Greg Hunter’s USAWatchdog.com WNW 207 9.11.15

Democrats are going to try to block Republicans from killing the Iran nuke deal. The Republicans do not have the 60 votes needed to stop a Democrat filibuster. So, Obama will not have to veto the Republican bill to stop the deal from going through. The Democrats are not even going to allow a vote on killing the deal. Ten Democrats are up for re-election, and none of them want to be on record voting to allow it to go through. This is far from over as the Republicans are looking for ways to kill the deal, and I am sure they will at least want Democrats on record allowing this to go through. They know this is a bad deal, if you want to call it that. It is really total capitulation as John Kerry admitted he did not have access to the side deal on inspecting Iran’s military nuclear sites. Iran’s top brass has said it will not issue the permits to inspect its military sites. There really is no deal. This is nothing more than theater from the Obama Administration.

Retail Silver Market Has Seized Up-David Morgan

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Silver expert David Morgan says prices of the white metal may be low, but demand is huge. Morgan explains, “I did a survey of many of the top wholesalers and retailers in the country and came to the conclusion that the retail side of the market has basically seized up. One of the biggest mints in the U.S. is backlogged about 4 million ounces. You have two other main government mints that are basically on halt and not producing, or trying to catch up. You have huge premiums in the silver bar market and extremely high premiums in the silver bag market, or what is referred to in the industry as junk silver. Dealers are paying $5 above spot to source silver bags. What that equates to for the cost of silver is about $19.25 an ounce, and we are in the mid-$14 range for an ounce of silver. So, obviously, there is a huge demand that cannot be met with the current supply in the retail market.”

America is Burning, More Money Printing Coming-Rob Kirby

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Macroeconomic analyst Rob Kirby says forget what you are hearing about the so-called “recovery.” The powers are hiding a coming collapse. The American economy is being propped up with fraud and crime and time is running out. Kirby explains, “The whole world is grading America and America is burning. When you are burning, it is really hard to put out a message or convince people that all is well. America is failing in spades at doing this. Rigging markets and acting in a sociopathic nature doesn’t make this job easier and doesn’t make it true because they say so. They have idiots making pronouncements that a weak jobs number is good tonic and a good basis for raising rates. It clearly isn’t. . . . We are living in “Alice in Wonderland” with the comments we are getting out of this administration.”

Iran Deal Done Deal, Middle East Tensions Mounting, Fake Economic Recovery

By Greg Hunter’s USAWatchdog.com (WNW 206 9.4.15)

By Greg Hunter’s USAWatchdog.com (WNW 206 9.4.15)

President Obama has now gotten enough Democratic senators to sustain a veto on the Iran nuke deal. Never mind that the details of the deal are being kept secret. Never mind that the so-called side deal to inspect Iran’s military nuclear sites is not known to Secretary of State John Kerry. Remember, he told Congress he “did not have access” to them. It appears the details of UN inspections of Iran’s nuclear sites is also a secret to Congress. If you want to know what is really in the Iran deal, just listen to the Iranians. They have been consistent from the beginning and say their nuclear military sites are off limits and said it again this week. Also, the sanctions end when the deal is in place. The Iranians also get $150 billion to boot, and even the Obama Administration admits there is no way of stopping them from using that money to support terror. The Obama Administration is celebrating this as a big foreign policy victory. The majority of Congress, and this includes some Democrats, are against the deal. The majority of Americans are against the deal. It was not a choice between war and a deal. It should have been a choice between a deal and a better deal that actually would lead to stability and peace in the Middle East. This deal will speed up the war prospects in the region, not slow them down.

Financial Facts and Shemitah Predicting Calamity Coming-Jeff Berwick

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial expert Jeff Berwick says you don’t have to wait for the next market crash. Berwick contends that financial facts and the so-called Shemitah are lining up and predicting a coming calamity. Berwick, who recently produced a video titled “Shemitah Exposed,” explains, “I think it’s already started. I put up that video in July, and by the end of August, we were already seeing major crashes happening around the world. The Chinese stock market has been in complete free fall. Of course, what happened in Greece, everyone knows about that, and there are actually 20 other stock exchanges . . . have all been in a crash in the last few weeks. My question is did the Shemitah start early this year or are these going to be pre-shocks to something that is going to be much, much worse? . . . September is going to be incredibly volatile and risky, and it might not just be September.”

Bond Market Explosion Not Stoppable-Craig Hemke

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial expert Craig Hemke says there is an explosion coming in the bond market–it’s just a matter of when. Hemke explains, “Yes, at some time eventually, yes, just because mathematically the debt based system is unsustainable. It’s now grown so large in the amount of continued debt that it takes to service the existing debt makes it all move exponentially against you, and it is spiraling towards an eventual failure.”

What can they do to stop the bond market from blowing up? Hemke contends, “You can’t. It’s not stoppable and it’s not sustainable. At some point, it simply collapses. As much as the pundits and money managers and talking heads on the financial TV want to convince everyone that everything is fine . . .and it’s just bliss and nirvana. Eventually, it is a mathematical certainty that the music stops. Getting back to China, we have ceded control of that to them . . . They can pull the plug on it whenever they want, and that is the most dangerous part of where we are headed.”

Market Pre-Crash, China Bumps US Debt, Biden Better than Hillary, Dems for Iran Deal

By Greg Hunter’s USAWatchdog.com (WNW 205 8.28.15)

By Greg Hunter’s USAWatchdog.com (WNW 205 8.28.15)

To say the stock market was on a roller-coaster ride this week is an understatement. Already, some are saying this action is just a blip. They say it’s a buying opportunity. They say it’s a correction and nothing more. My sources say none of that is true, that this is just the warm-up act of a much bigger downturn. Charles Nenner told me this is just the pre-crash. The big crash is coming. Gregory Mannarino of TradersChoice.net, who called the top in this market more than 2,000 points ago, says market crashes are not a one and done event but a process. He says the 2008 meltdown started in September and didn’t finish until March of 2009. It only ended with massive QE and money printing and suspension of accounting rules by FASB. Fast forward to today, and we have reports of China selling U.S. debt (Treasuries) because China’s markets are in turmoil. In simple terms, they need the cash to try to stabilize their markets. ZeroHedge.com is reporting that when China sells Treasuries, it is really QE or money printing in reverse. It is reported that if China sells enough Treasuries, it could spike interest rates. Funny, former Fed Head Alan Greenspan also recently warned that a bond bubble could explode and spike interest rates. What happens if every other country sells a chunk of the more than $16 trillion of liquid U.S. government debt all at the same time? This is the scenario economist John Williams has been warning against and will be here for an update next week.