Latest Posts

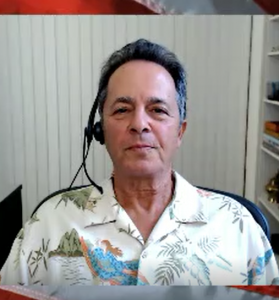

Deflation & Barter Economy Coming – Rick Ackerman

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Analyst, financial writer and professional trader Rick Ackerman is forecasting a “deflationary end” to our debt-bloated financial system. Ackerman contends, “I think everybody agrees we have more debt than we can ever repay. So, it’s going to have to be repaid one way or another. The debt has to be discharged. Every penny of every debt has to be paid, if not by the borrower, by the lender. Hyperinflation would let borrowers skip free. . . . The powers that be are not going to go for that. The lenders are going to be in charge. This is why I said all of the mortgage contracts will come to resemble leases. This is so the lenders don’t wind up evicting 110 million Americans from their homes. . . . Things have gotten far crazier than I could have imagined a decade ago when I was forecasting a deflationary end.” (more…)

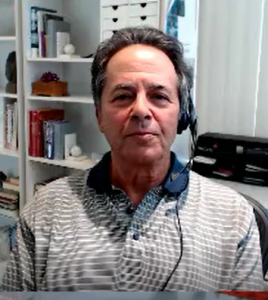

Complete Collapse of Everything – Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Analyst, financial writer and professional trader Rick Ackerman points out that you cannot underestimate the extreme amount of debt and money printing propping up the economy. Ackerman thinks, “It’s an inflationary bubble, and that’s why I think it’s going to bust. I think it’s going to last as long as the bull market lasts. . . . Companies go out and borrow money to buy back their own shares. It feels like a perpetual motion as far as a bull market in stocks, but even that ends. It’s created a bubble, and bubbles only pop.” (more…)

No Upper Limit to Bitcoin – Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Analyst, professional trader and financial writer Rick Ackerman says buckle up because Bitcoin is going to go much higher in price. Elon Musk is the latest in a line of billionaire investors that have bought the crypto currency that is now in the mid $40,000 range per unit. Ackerman says, “Bitcoin is pure speculation, and we are in a phase right now where the big players absolutely know they can’t lose. Just buy it now and announce in four weeks, six week or two months that they bought it, and it just keeps going up. (more…)

Everything Will Come Tumbling Down – Rick Ackerman

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Analyst, professional trader and financial writer Rick Ackerman says don’t expect the trillions of dollars of borrowed money given away in government stimulus to save the economy. It will not. Ackerman explains, “For every dollar of debt we create, we only get 33 cents of growth. . . . The stimulus is having less and less of an effect, and because it has less of an effect, it stimulates the stimulators to do even more stimulating, which essentially means more borrowing. So, that’s what’s called a debt trap, and we are very much in it. . . . (more…)

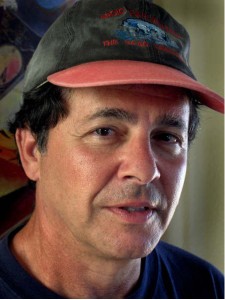

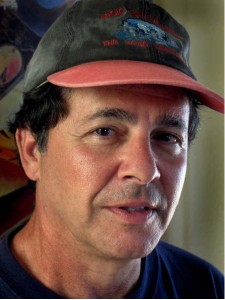

Interesting Depression & Period of Living Without – Rick Ackerman

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial writer and professional trader Rick Ackerman says the economy is tanking, and there is no way to avoid an economic depression. Ackerman explains, “It’s going to be an interesting depression because we have all the infrastructure of affluence. We have achieved a pinnacle of affluence, and the metaphor I use is riding to the soup kitchen on an $8,000 trail bike. . . . I hope we find things that make life worth going on without all the stuff. So, we are going to be in a period of living without all the good stuff, and that is going to be the norm. There is also a really hopeful side to economic distress, but we are most surely headed into a period of severe distress . . . and a period of living without. We will find we are not living without things that are intrinsic to human nature that are good. . . .We going to have to find ways to get along because we are headed into hard times.” (more…)

Fed Out of Bailout Bullets – Rick Ackerman

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial writer and professional trader Rick Ackerman says don’t expect a replay of the 2008-2009 financial crisis where the Federal Reserve bailed out almost everything in sight. Ackerman explains, “It ended up Lehman Brothers went under, and they needed a couple of sacrificial lambs, along with Bear Stearns. It could have just as easily been, and it might be the next time, Goldman Sachs. So, in that way, the Fed is kind of out of bailout bullets. We’ve already been through a bailout where it took a big hunk of the financial system. Each one takes more bailing out to get to that critical threshold of credibility where the bailout itself works.” (more…)

$1 Quadrillion Global Derivative Market Means Deflation – Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer and professional trader Rick Ackerman says get ready for extreme deflation, not inflation. In his mind, the deflation scenario is building. Ackerman says, “Yes, it is. When you talk about $22 trillion in federal debt, that is really a drop in the bucket because the bigger piece of it is in the global financial markets, mainly in the derivative instruments. The notional value of that totals a quadrillion dollars, and all of that is what I call ‘unactualized deflation.’ Each transaction in that quadrillion dollar market has a dollar debtor in it. At some point, people are going to be stretched to pay those dollar debts and short term loans or short term paper is not going to settle up the way it usually does, and you will not be able to roll that short term debt. People will be forced to pay and settle up in cash, and I think that is when you will see a short squeeze on the dollar. That will push the dollar’s value up enormously compared to all other currencies.”

Financial Collapse to Wipe Away All the Lies-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial analyst Rick Ackerman says the mother of all market meltdowns is a sure thing. It is just a question of when, and when it starts, it will simply implode at a stunning pace. Ackerman explains, “We’re in a situation now where any day something can happen. I think that the black swan will be something like the stock market starting down for no apparent reason. That in itself would trigger the implosion, and I think the only thing that is propping up the markets now is the mentality of . . . how bad can things be if the stock market is trading within shooting distant of all-time highs? I think the stock market is the main buttress of this enormous hoax that has been going on with easing (QE or money printing).”

Strong Dollar is Black Swan-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader/analyst Rick Ackerman says forget about the demise of the U.S. dollar anytime soon, Ackerman contends, “I have been totally bullish on the dollar for years, and it looks like clear sailing to me. The dollar is certainly responding to what I would call economic fundamentals, even though bonds have been on this odd holding pattern for a while based on a wishy-washy Fed. I see nothing but a strong dollar because if you look at the global derivative market, it implies a dollar long and a dollar short position. . . . The side that has to pay back in dollars is effectively short it. So, we have this monstrous derivatives market, and some experts put it at a quadrillion and a half dollars, and it represents a huge short position on the dollar, and the squeeze is starting to happen now.”

Dot-Com Style Crash Coming-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial analyst and newsletter writer Rick Ackerman is no stranger to contrarian calls. At the beginning of 2014, he said forget about rising interest rates because they were going down. They did. Now, Ackerman predicts rates will go lower and will stay low for a long time. Ackerman explains, “My perspective is that of a deflationist, and it’s been easy for me to see. Even though we have inflation in certain things . . . the much bigger picture is deflationary. It is that huge $1 quadrillion edifice the central banks are fighting to keep from imploding. (more…)

Obama Care-Absolute Abomination will Collapse Under its Own Weight-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader/analyst Rick Ackerman is feeling a little less nervous about the negative effects of Obama Care. Ackerman contends, “I think, at this point, we’re blessed with a package that is such a bloated abomination that it’s going to collapse under its own weight. It seems pretty obvious the program simply won’t fly.” (more…)

Obama Care-Economy Can’t Survive It-Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Trader and forecaster Rick Ackerman says, “As far as the Fed getting off the easing regimen, it’s not possible . . . You’d kill the system right now. There’s no way out, and although we put off the day of reckoning, it can’t be put off indefinitely.” (more…)

Sandy Damage-$150 to $250 Billion-Rick Ackerman

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

Financial analyst and forecaster Rick Ackerman says Hurricane Sandy came at a time when “. . . the U.S. economy is in a mission critical status. . . . All of the positive effects of this spending are 8 to 20 months down the road.” Ackerman says this disaster is going to be different than in the past because “we’re living off the fatted calf, but the fact is now we’re broke. Where is all this money going to come from?” You can forget the current mainstream media estimates of $50 billion in storm damage. (more…)

One-on-One With Rick Ackerman

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

Professional trader Rick Ackerman thinks “the next market meltdown is going to look like the flash crash” of a few years ago. Ackerman is the creator of an investment newsletter called “Rick’s Picks.” He says the dollar is “ultimately garbage” and is backed by “nothing but debt,” but that doesn’t mean the dollar will crash in the near term. Ackerman thinks it’s “going much higher” before it goes lower. (more…)

Election Rigging 2024, Lahaina Cover-Up, Deflation Destroys

By Greg Hunter’s USAWatchdog.com (WNW 597 9.1.23)

By Greg Hunter’s USAWatchdog.com (WNW 597 9.1.23)

All the trouble Donald Trump is facing comes down to one simple thing that scares the heck out of the “Deep State” globalists. Trump could win, and win big in 2024—period, the end. A second Trump presidency could destroy everything the so-called “Uni-party” holds dear. (more…)

- 1

- 2