Latest Posts

There’s A Lot Less Real Money Out There

A while back, I made a prediction that something bad was going to happen before the end of 2011. I think the recent stock market plunge qualifies as “something bad.” Where have all the trillions of dollars gone from the stock market? I think Wall Street is up to its old tricks and harvested the public’s hard earned 401-k money—again. The stock market has been an awful place for the “buy and hold” investor to park his money for the past 11 years. The little guy has been fleeced time and again by the short selling sharks. (more…)

Don’t Bet Against Gold or Silver

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

You have to respect the power of the Federal Reserve when just a statement can turn the entire stock market around in a day. Yesterday, the Fed admitted the economy was not good and in a statement said, “. . .downside risks to the economic outlook have increased.” Because the economy is tanking, the Fed promised to keep a key interest rate at near 0% for “. . . at least through mid-2013.” (more…)

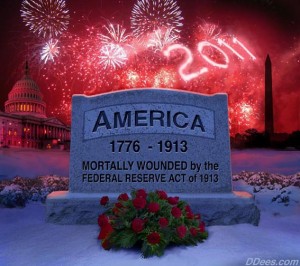

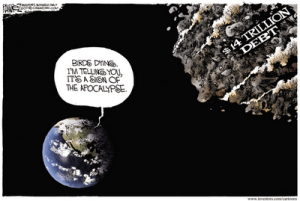

Ramifications of a U.S. Debt Downgrade

The U.S. debt downgrade is really more than a tiny one notch cut in the credit worthiness of the U.S. One talking head on television said yesterday that there was never any question that the U.S. would repay its debt because the country can print money. The talking head is correct but does not take into consideration the future buying power of the repayment dollars. Printing money at the rate the Fed has been doing devalues the currency and, in effect, allows the government to default with dollars with reduced buying power. This is precisely why Bill Gross, head of the world’s biggest bond fund, PIMCO, said recently that people who invest in Treasuries will “get cooked.” (more…)

Brace for Impact

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

“Brace for Impact.” I have thought about this economic collapse title for months. I held onto it and figured I would know when the right time was to put it out there. Today is the day. Watching mainstream media (MSM) this weekend, you would think a one notch downgrade to America’s debt doesn’t really matter. For example, former CNBC anchor Erin Burnett said Friday night on CNN the downgrade was “already priced into the market.” The panel spoke as if the first U.S. debt downgrade in history was no big deal. To that I say, positively absurd! (more…)

Weekly News Wrap-Up 8/5/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big drop in the Dow is the result of a global solvency crisis. The U.S. is spending money by the trillions, and Europe is headed for a crash touched off by Italian debt. The economy is stalling. The Federal Reserve, no doubt, is contemplating another round of money printing to bail everybody out—again! Even gold and silver sold off. Is the Bull market in precious metals over? It’s all covered by Greg Hunter in the “Weekly News Wrap-Up” on USAWatchdog.com. (more…)

Global Stock Sell-Off!!!

Greg Hunter’s USAWatchdog.com

Today’s 500 plus point sell-off is pretty self-explanatory against a world-wide rout in stocks. The world is deeply in debt, and there is no quick fix. Europe and America are slowing down and taking the rest of the world with them. Italy is also having major trouble handling its debt, right along with the other PIIGS (Portugal, Italy, Ireland, Greece and Spain). Italy is the 8th largest economy in the world. You thought Greece was a problem? Wait until Italy cries bailout or default. (more…)

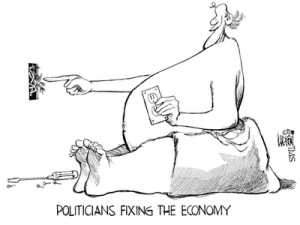

Deficit Will Grow While Economy Shrinks

I appreciate what the Tea Party and folks like Congressman Paul Ryan are trying to do. Mr. Ryan, who is the House Budget Committee Chairman, said when the debt deal passed, “This is a down payment on the problem and it’s a good step in the right direction.” Ryan went on to make what is probably the most important point, “And it is a huge cultural change to this institution.” Amen to that Mr. Congressman, but this debt reduction bill is like trying to bail water out of a battleship with a thimble. (more…)

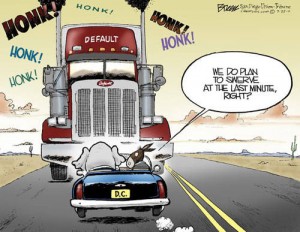

Phony Deadline, Bogus Debt Limit Deal

By Greg Hunter’s USAWatchdog.com

Today, the President signed into law a $2.4 trillion debt ceiling increase contained in a so-called deficit reduction bill. This was done under the threat of defaulting on the debt of America, if a deal was not reached by August 2nd. The deadline was completely bogus because the government had ample funds coming in every month to service Treasury debt. (more…)

A Deal Everybody Hates

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Everybody is thinking the debt ceiling deal is a done deal. To that I say, not so fast. First of all, this is a deal everybody hates including the President. That doesn’t mean he won’t sign the legislation when it comes across his desk—he will. The leaders in Congress have agreed to a plan, but the trick is going to be getting it through the House and Senate. (more…)

Weekly News Wrap-Up 7/29/11

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

The debt ceiling impasse is a monster story and, once again, it tops our Weekly News Wrap-Up (WNW) on USAWatchdog.com. I have been saying for more than a week Congress is going to miss the August 2nd deadline for getting a deal done to avoid default. Yesterday did not change my mind. The two parties are as far apart as ever. The U.S. will not default on Treasury debt, but many bills are not going to be paid. (more…)

You Cannot Doubt the Gold Bull Market

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. (more…)

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. (more…)

Debt Downgrade, Not Default, is the Problem

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

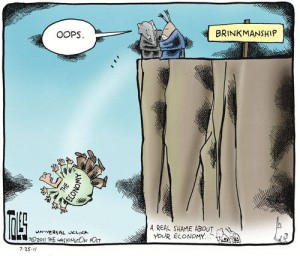

Watching the debt negotiations is like watching two stubborn people headed over a waterfall. Both are too blockheaded to steer the boat towards land on the left or the right. So, both go over the edge and will see how long the other can hold his breath. Both, of course, drown in this story, right along with the rest of the country. Yesterday, Speaker Boehner said he wanted to call the President’s bluff and not give him a “blank check.” (more…)

Robo-Signing Banks Not Off Hook

By Greg Hunter’s USAWatchdog.com

Last week, this story from Reuters really got me upset. The headline read: “States negotiating immunity for banks over foreclosures.” The story said, “A coalition of all 50 states’ attorneys general has been negotiating settlements with five of the biggest U.S. banks that would include payment of up to $25 billion in penalties and commitments to follow new rules. (more…)

Running out of Runway

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

It looks like even the mainstream media (MSM) can see a calamity if we are right on top of one. Finally, the dire debt ceiling negotiations between Congress and the White House were covered wall-to-wall on all the major media outlets yesterday. No comment better describes the frightful situation America faces over its debt problem than what Treasury Secretary Tim Geithner said yesterday on FOX (more…)

Weekly News Wrap-Up 7/22/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

“Deal or No Deal.” That’s what I am now calling the debt ceiling debate between Congress and the White House. I said last week that it is going to be tough getting tax increases and spending cuts big enough to get a $2.5 trillion raise in the debt ceiling through the House of Representatives. (more…)