Latest Posts

Weekly News Wrap-Up 2.24.12

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Syria is the top story, this week, because the bloody revolution there has big super power war implications. This violent uprising against Bashar Assad has been going on for months. Two journalists covering the story were killed in the fighting. Now, there is talk of a NATO type involvement much the same as Libya. (more…)

Greek Debt Deal Done—Yeah Right

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I keep asking myself, when is a deal not a deal? Every time I hear the words “Greek debt deal” or “Greek bailout” in the same sentence, I wonder if, this time, they really have a deal. Yesterday, I was thinking that again when it was announced there was a new Greek debt deal. The headline from Reuters read, “Europe seals new Greek bailout but doubts remain.” (more…)

Consequences of Iran-Israel War

The latest headline proves, once again, Iran and Israel are moving closer to war. The only question is when. A headline, today, from Debka.com said, “Tehran steps into US-Israel Iran row with threat of pre-emptive strike.” The story goes on to say, “Deputy Chief of Iran’s Armed Forces Gen. Mohammad Hejazi issued a new threat Tuesday, Feb. 21: “Our strategy now is that if we feel our enemies want to endanger Iran’s national interests… we will act without waiting for their actions.” debkafile’s military sources report that an Iranian preemptive attack on Israel has been in the air for some weeks. (more…)

The latest headline proves, once again, Iran and Israel are moving closer to war. The only question is when. A headline, today, from Debka.com said, “Tehran steps into US-Israel Iran row with threat of pre-emptive strike.” The story goes on to say, “Deputy Chief of Iran’s Armed Forces Gen. Mohammad Hejazi issued a new threat Tuesday, Feb. 21: “Our strategy now is that if we feel our enemies want to endanger Iran’s national interests… we will act without waiting for their actions.” debkafile’s military sources report that an Iranian preemptive attack on Israel has been in the air for some weeks. (more…)

Inflation Everywhere but MSM Says NOT

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It seems every chance the mainstream media (MSM) gets, it tells us things really aren’t that bad. For example, the headline from the Associated Press (AP) said, “Consumer prices on the rise, but inflation outlook is benign.” Who approves the headlines at the AP? Prices are rising, but there is no inflation? Aren’t rising prices the main ingredient of inflation? (more…)

Weekly News Wrap-Up 2.17.12

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big story is the continued threat of World War III in the Middle East. Israeli Prime Minister Benjamin Netanyahu said, this week, sanctions are not working on Iran; and the U.S. Senate is talking about a “time table” to stop Iran’s nuclear program. A new bi-partisan resolution says that containing a nuclear armed Iran is not an option. These are just two more signs that war in the Middle East is approaching. The only question is when? (more…)

U.S. Dollar Will Take Beating in the End

By Greg Hunter’s USAWatchdog.com

In the simplest of terms, the U.S. dollar will take a beating in the end. That is going to be the result of all the bailouts and money printing to save an insolvent banking system. Today, I bring you two videos that speak to the dollar calamity that lies in front of the entire planet. (more…)

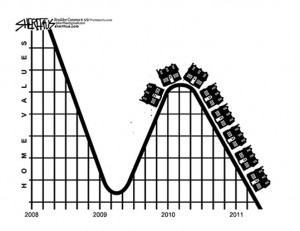

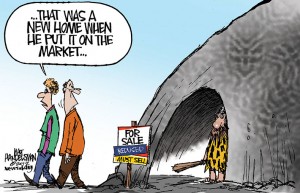

Mortgage Settlement Not Only Thing Plunging Prices

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

New data just released revealed delinquency rates for mortgage holders is up in the last quarter of 2011. Now, the national mortgage delinquency rate is 6.01%, up from 5.88% in the third quarter of 2011 according to TransUnion. This downward trend in real estate prices will not be slowed by this bad news. (more…)

World Crisis in Pictures

By Greg Hunter’s USAWatchdog.com

It is said “a picture is worth a thousand words,” and the following story features more than a dozen from Greece, Europe and the Middle East where people are protesting the burden laid on them by the crooked, wreckless bankers. Nothing is settled in the European debt crisis, and the deal in Greece is on and off and on and off. This summer, journalists in the USA will probably see some of the same photo opportunities. (more…)

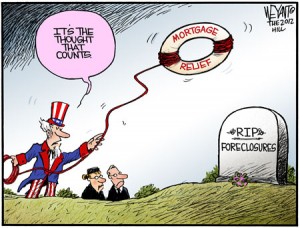

Mortgage Settlement Will Plunge Real Estate Values

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It is official. State and federal governments have condoned forgery, perjury and fraud in what’s been called the “robo-signing” foreclosure debacle. Last week, the five biggest banks in America signed on to a $26 billion deal that, basically, lets them off with a slap on the wrist for fraudulently foreclosing on homes in the last few years. (more…)

Weekly News Wrap-Up 2.10.12

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big news, this week, was the $25 billion mortgage settlement with the five biggest banks in the country over allegations of mortgage and foreclosure fraud. It has been reported that $13.5 trillion of potential fraud is going uninvestigated and unprosecuted. This settlement is a travesty of justice and a total rip-off of America. (more…)

Fed’s Free Money Isn’t Really Free

Bless You, D. Sherman Okst

By Greg Hunter’s USAWatchdog.com Today, I received a personal email from D. Sherman Okst titled “F*** You.” Okst is an Internet financial writer that, I think, does some very good work. So, I was taken back when Okst wrote (more…)

By Greg Hunter’s USAWatchdog.com Today, I received a personal email from D. Sherman Okst titled “F*** You.” Okst is an Internet financial writer that, I think, does some very good work. So, I was taken back when Okst wrote (more…)

Dollar and America on the Road to Ruin

By Greg Hunter’s USAWatchdog.com (revised)

By Greg Hunter’s USAWatchdog.com (revised)

In the last week or so, I’ve noticed an unusual amount of really well written and researched articles warning of impending doom and financial horror. These articles are not written by a bunch of angry uneducated bloggers but by money managers, investors and financial writers. All are people who got it right leading up to the meltdown of 2008, and my bet is they are right again. (more…)

Will Big Banks Get Free Pass in Robo-Signing Mortgage Mess?

By Greg Hunter’s USAWatchdog.com

The State AG’s are supposed to settle the enormous mortgage mess for a mere $25 billion. The alleged fraud has been reported to be in the neighborhood of $13.5 trillion. Will the crooked big banks who perpetrated this scam on America get a free pass in the so-called “robo-signing” mess? (more…)

8.3% Unemployment Lie

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The most recent unemployment number is a total lie, and that lie was repeated all over the mainstream media (MSM). Two sins were committed here, and I don’t know which one is worse. The report was a sham, and the MSM reported that information without a single question about its accuracy. (more…)