Latest Posts

Little Growth Means Big Trouble

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Second quarter GDP growth numbers were revised down last week to a paltry 1.6% from 2.4%. Wall Street celebrated because some were expecting “growth” to be revised even lower. The stock market shot up on this news, but should everyone feel relieved because the U.S. got at least some growth? (more…)

Ground Zero Mosque is a Distraction

By Greg Hunter’s USAWatchdog.com I think the problems we face as a nation are much more important than building a mosque in lower Manhattan. The only reason I am writing about this is because it is an issue that I feel is being used to distract the country from the PROFOUND financial problems we face. They have now got the attention of the military. Adm. Mike Mullen, Chairman of the Joint Chiefs of Staff, warned last week that the national debt is the single biggest threat to national security! (more…)

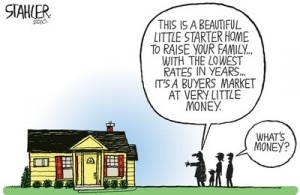

Housing is Dragging the Economy to Hell

A little more than two months ago, banking analyst Meredith Whitney said on CNBC, “Unequivocally, I see a double-dip in housing. There’s no doubt about it . . . prices are going down again.” I’d say unequivocally she was spot on. A few of the hellish headlines dragging the economy down include: Existing home sales dropped 27.2 percent from June. That is a record drop and a 15 year low. One in ten mortgage holders in America face foreclosure, according to a new report by the Mortgage Bankers Association. U.S. home prices fell 1.6 percent in the second quarter from a year earlier as record foreclosures added to the inventory of properties for sale. (more…)

Standing Up When It’s Too Late

This article is comparison between America and another great empire faced with rot in high office and a decline of state—Rome. The writer, JR Nyquist, artfully points out it’s not the big events that sink an empire but many seemingly little ones. You could call what is happening to the U.S. “death by a thousand cuts.” Except in this story, people are not really aware how deep the cuts are and exactly who is doing the cutting. I loved this piece, and I hope you do as well. Greg Hunter (more…)

This article is comparison between America and another great empire faced with rot in high office and a decline of state—Rome. The writer, JR Nyquist, artfully points out it’s not the big events that sink an empire but many seemingly little ones. You could call what is happening to the U.S. “death by a thousand cuts.” Except in this story, people are not really aware how deep the cuts are and exactly who is doing the cutting. I loved this piece, and I hope you do as well. Greg Hunter (more…)

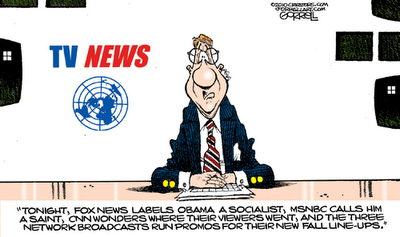

Mainstream Media is Crushing Public Confidence

By Greg Hunter’s USAWatchdog.com

Recently, a new Gallup poll delivered some bad news to mainstream media–only one fourth of people asked believe what it says. The Gallup story said, “Americans continue to express near-record-low confidence in newspapers and television news (more…)

Why is the U.S. Government Protecting BP?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A little more than 2 weeks ago, the government said nearly 75% of the oil from the worst environmental disaster in history was gone! Government scientists claim most of the oil had dissolved, dispersed or been removed. Now, government scientists are defending their claims against a new report from University of Georgia scientists. (more…)

Does the Mainstream Media Lie by Omission?

The writer of the following article publishes a very successful local newspaper called the “Rhino Times.” John Hammer is a 33 year newspaper veteran. He has a big local following in Greensboro, North Carolina, and thinks big. One of the recurring themes of USAWatchdog.com is something I call “The Soft Truth.” It happens frequently because the mainstream media does cheap superficial stories and ignores what I call the “Hard Truth.” Hammer’s piece is less about taking President Obama down and much more of an indictment of what the mainstream media is NOT telling you. (more…)

The writer of the following article publishes a very successful local newspaper called the “Rhino Times.” John Hammer is a 33 year newspaper veteran. He has a big local following in Greensboro, North Carolina, and thinks big. One of the recurring themes of USAWatchdog.com is something I call “The Soft Truth.” It happens frequently because the mainstream media does cheap superficial stories and ignores what I call the “Hard Truth.” Hammer’s piece is less about taking President Obama down and much more of an indictment of what the mainstream media is NOT telling you. (more…)

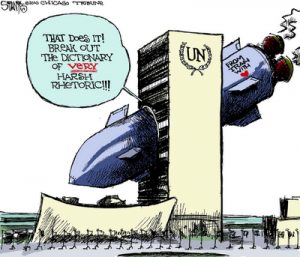

Is an Attack On Iran Imminent? If So, Then What?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A story that came out on Friday the 13thhas ominous implications for the Middle East and the world. It was reported by FOX news last week, Russia is planning to supply fuel rods to Iran’s Bushehr nuclear reactor by this coming weekend. (Iran would be able to make nuclear weapons through the plutonium it could reprocess out of spent fuel rods.) That effectively means if Israel is going to attack the reactor, it must do it before Saturday, August 21. If it waits until after the reactor starts producing power, it will risk a radiological disaster in the Persian Gulf. (more…)

What America is Feeling and Thinking Coast to Coast

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This past week I was a guest on the nationwide overnight radio show “Coast to Coast AM”. The show airs on more than 500 radio stations and is heard by millions. I am grateful to George Noory, for allowing me to become a bit of a regular on his show. Every time I am on, I am flooded with emails and comments. This is a great way to check the pulse of America to find out what people are feeling and thinking. (more…)

The Queasy Season

The following article was written by James Howard Kunstler, I thought this would be a nice follow to Monday’s post “When Will Financial Armageddon Begin?” My take on this excellent piece–big changes are baked into the cake already. The US economic crisis is real!

The following article was written by James Howard Kunstler, I thought this would be a nice follow to Monday’s post “When Will Financial Armageddon Begin?” My take on this excellent piece–big changes are baked into the cake already. The US economic crisis is real!

He also seems to agree with me, that bad things are going to start happening sooner than later when it comes to the economy. Also, there is going to be significant political change coming as well.

Kunstler is a strong bright voice, and what he says should bring your world into better focus. Enjoy the article — I did. –Greg Hunter– (more…)

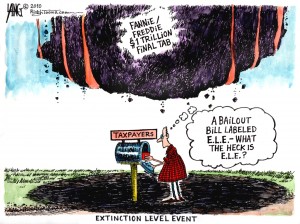

When Will Financial Armageddon Begin?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A little more than two years ago, economist John Williams of shadowstats.com predicted a “severe recession” was coming and soon. At the time, I was working as an investigative correspondent for CNN. I interviewed Williams for a story about the coming financial crisis. Most so-called experts, at the time, did not see the financial meltdown coming, let alone that all the banks were in trouble. (more…)

Greg Hunter Guest Hosting on Radio

By Greg Hunter’s USAWatchdog.com

Last week I was asked to be a Guest Host on a very popular morning talk radio show here on the East Coast. It’s called “The Brad and Britt Show.” It airs on WZTK-FM 101.1. The station broadcasts in Central North Carolina and reaches the biggest cities in the state. I filled in for Britt. Both Guys are extremely talented and well liked, so I had my work cut out for me. I have chosen a few links to some highlight clips. The links below will take you to the station website (WZTK 101.1) so you may listen.

Let Them Eat Cake

Guest Writer for Greg Hunter’s USAWatchdog.com

It is not unusual for members of the diminishing upper middle class to drop $20,000 or $30,000 on a big wedding. But for celebrities this large sum wouldn’t cover the wedding dress or the flowers. (more…)

Money Printing Is Our Best Bet

Monday started out with a bang! There were strong earnings reported from some big banks, manufacturing rose for the 12th straight month, construction spending edged up (mainly due to government projects) and the stock market jumped 200 points. Problem solved—economy back on track, right? Wrong! Tuesday, everything changed. (more…)

The Year America Dissolved

Guest writer for Greg Hunter’s USAWatchdog.com

It was 2017. Clans were governing America.

The first clans organized around local police forces. The conservatives’ war on crime during the late 20th century and the Bush/Obama war on terror during the first decade of the 21st century had resulted in the police becoming militarized and unaccountable. (more…)