Latest Posts

New Great Depression Coming in 2021 – Jim Rickards

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Five time. best-selling financial author James Rickards contends all this money printing to retard the effects of CV19 is not going to produce inflation—just the opposite. Rickards explains, “Let’s say I go out to dinner and I tip the waitress. The waitress takes a taxi home, and she tips the taxi driver. The taxi driver takes the tip money and puts gas in his car. In that example, my $1 tip had a velocity of three: the waitress tip, the taxi tip and the gasoline. So, my $1 produces a velocity of three. My $1 produces $3 of goods and services. That’s velocity, but what if I stay home, don’t go out and don’t spend any money? (more…)

More Voter Fraud Revealed, Election Not Over, 2021 Economic Update

By Greg Hunter’s USAWatchdog.com (WNW 464 1.1.2021)

By Greg Hunter’s USAWatchdog.com (WNW 464 1.1.2021)

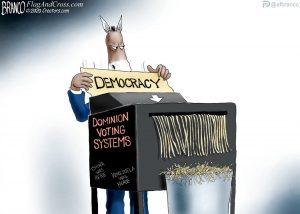

More this week on the 2020 election fraud, this time in Georgia, and, yes, there was more proof and lots of it. We find that Georgia voting machines were sending information to China, ballots were being shredded and people were caught on camera running the same stacks of ballots through the counting machines three and four times. If that’s not election fraud, I don’t know what is. As more and more fraud is exposed, the cover-up grows more and more desperate. More than just voter fraud is being revealed, and it looks like treason and sedition. (more…)

Deep State Freaked Out Trump Not Giving Up – Alex Newman

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Journalist Alex Newman says don’t let all the calls for President Trump to step down fool you into thinking Trump is a one term President. The Deep State Democrat globalists never imagined Trump would fight this hard against the massive election fraud that made Biden the pretend president. The Deep State is freaking out, and this is why so many on both sides are calling for Trump to give up. He’s NOT going to simply give into massive fraud. Newman says, “I think the Deep State is very, very concerned about what President Trump might be thinking. The President is clearly promising to fight. (more…)

Trump Election Battle Continues, Christmas Message 2020

By Greg Hunter’s USAWatchdog.com (WNW 463 12.25.2020)

By Greg Hunter’s USAWatchdog.com (WNW 463 12.25.2020)

The election fraud battle is far from over, and President Trump does not look like a man who is ready to give up–quite the contrary. If you want an excellent summation of all the fraud and crime that has been uncovered since Election Day, please watch the President’s 14 minute video outlining the outrageous scam that the 2020 Election really was. These are facts and NOT some tinfoil hat theories that the Left and corrupt propaganda mainstream media (MSM) keeps telling you. Trump is not giving up, and neither should you accept the pretend president Joe Biden. Trump won by a record number of votes for a sitting President, and that too is a fact no matter how much Big Tech or the propaganda MSM tells you there was no election or voter fraud. God is going to weigh in on this, and the Dems, globalists and Satan worshipers will not be liking what God has for an outcome to the 2020 Election. (more…)

Governed by Demonic Spirit or Divine Intelligence – Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com (Saturday Post)

By Greg Hunter’s USAWatchdog.com (Saturday Post)

Investment advisor and former Assistant Secretary of Housing Catherine Austin Fitts says the so-called “reset” is here, and this means the old system has to be destroyed. The number one goal of reset architects is destroying Jesus and all of his Christian believers. Fitts explains, “You hold up the dollar and what does it say? ‘In God We Trust.’ So, a liquid currency with the breadth of the dollar depends on faith and faith in a divine intelligence. You know, that there is something bigger. (more…)

Election PR Battle, Supreme Court MIA, Economic Update

By Greg Hunter’s USAWatchdog.com (WNW 462 12.18.2020)

By Greg Hunter’s USAWatchdog.com (WNW 462 12.18.2020)

The election battle is as much about public relations (PR) as it is about actual evidence. Massive amounts of evidence have come out about things like voting machines flipping votes, huge drops of ballots in the middle of the night and reports of outright fraud in multiple states. Still, not even the Supreme Court will give these claims a fair hearing. So, the PR and education from the Trump side continues to gain steam ahead of the all-important vote in Congress to make official the Presidential Election. (more…)

Everything Will Come Tumbling Down – Rick Ackerman

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Analyst, professional trader and financial writer Rick Ackerman says don’t expect the trillions of dollars of borrowed money given away in government stimulus to save the economy. It will not. Ackerman explains, “For every dollar of debt we create, we only get 33 cents of growth. . . . The stimulus is having less and less of an effect, and because it has less of an effect, it stimulates the stimulators to do even more stimulating, which essentially means more borrowing. So, that’s what’s called a debt trap, and we are very much in it. . . . (more…)

YouTube Censors, Texas Sues & Unemployment Jumps

By Greg Hunter’s USAWatchdog.com (WNW 461 12.11.2020)

By Greg Hunter’s USAWatchdog.com (WNW 461 12.11.2020)

In a surprising move, YouTube is telling its users that it will “. . . remove videos questioning the Biden election victory.” This to me seems like a panicked reaction to the mounting evidence of voter irregularities and problems coming out of the 2020 Election. (more…)

Trump Will Win in Supreme Court – Gerald Celente

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Gerald Celente, a top trends researcher and publisher of The Trends Journal, predicted Trump would win the November election, and he was well on his way to victory when the massive voter fraud and cheating was enacted by the Democrats. Celente also predicted in early September here on USAWatchdog.com, “Trump is a fighter. He’s not going to go down, and he will use the power of the Presidency to extend this thing as much as he can proving fraud and not leaving because of that. . . .” Fighting is exactly what team Trump is doing now. (more…)

RICO Election Treason, MSM Ignores Fraud, Dollar Trouble

By Greg Hunter’s USAWatchdog.com (WNW 460 12.04.2020)

After many hours of election fraud hearings in Pennsylvania, Arizona, Michigan and, most recently, Georgia and Nevada, a picture of well organized election and voter fraud has emerged. The election steal was organized crime that would make mobster John Gotti blush. The 2020 Election is a treasonous RICO election and voter fraud case pure and simple. There are hundreds of sworn affidavits from people who witnessed all sorts of fraud in multiple states. (more…)

Awakening Not Reset Coming – Bo Polny

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Biblical cycle expert and financial analyst Bo Polny says believe it or not, we are living in the “End Times” talked about in the Bible. Polny explains, “We are living in Biblical times, and we are about to see Biblical things go down. God is in control of this. . . .This is like the time of the Red Sea and Moses. Everything looked bleak and horrible. You had Pharaoh’s army charging Moses, and the Israelites were pinned up against the Red Sea. All of a sudden, God gets involved, and what happens? (more…)

Voter Fraud Exposed in PA, Same Voter Fraud Everywhere, Happy Thanksgiving

By Greg Hunter’s USAWatchdog.com (WNW 459 11.26.2020)

By Greg Hunter’s USAWatchdog.com (WNW 459 11.26.2020)

Voter fraud was on display Thursday at a hearing put on by the Pennsylvania State Legislature. The hearing was given to legislators responsible for allocating the state’s 20 Electoral College votes for President of the United States. Massive voter fraud was alleged by Rudy Giuliani, who is spearheading the President’s election legal team. Giuliani highlighted dozens of people who witnessed fraud on many levels. One expert testified Biden had nearly 600,000 votes dumped on his side of the ledger, while Trump vote dumps were 3,200. (more…)

Hyperinflationary Great Depression Coming – John Williams

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post)

Economist John Williams says don’t think the happy news on CV19 vaccines is going to get the economy back to normal anytime soon. Williams explains, “Put all the political turmoil aside for the moment. The markets respond that this (CV19 vaccines) is going to turn the economy. My point is it is not going to turn the economy . . . at least not soon because of what has happened to the economy and the severe structural damage. We have had a lot of companies go out of business, in particular, small companies. A lot of people have suffered, and we are going to have more of that going ahead.” (more…)

Trump Election Plan, Massive Voter Fraud, MSM Propaganda

By Greg Hunter’s USAWatchdog.com (WNW458 11.20.2020)

By Greg Hunter’s USAWatchdog.com (WNW458 11.20.2020)

The President’s election legal team put on a 90 minute press conference on Thursday that laid out their plan to overturn the election by exposing “massive voter fraud.” The President’s point man on the effort, Rudy Giuliani, says he can “overturn the election in Georgia, Michigan, Pennsylvania, Wisconsin, Nevada and Arizona with more than double the votes needed.” (more…)

2020 Election Most Corrupt in American History – Martin Armstrong

By Greg Hunter’s USAWatchdog.com (Saturday Night Post–corrected)

By Greg Hunter’s USAWatchdog.com (Saturday Night Post–corrected)

Legendary financial and geopolitical cycle analyst Martin Armstrong said his computers picked up massive fraud coming in the 2020 Election years ago. Armstrong explains, “The computer doesn’t ask my opinion, or anybody else’s, it just goes on the numbers from the economic data. It’s never been wrong. Besides 2016 (predicted Trump win) and for this one, it said it would be the most corrupt election in American history. I published this out at least two years ago. People have to understand, this isn’t my opinion. This has gone far beyond anything I would have anticipated. Every election you have had dead people voting. That’s pretty standard, and that’s not something new. . . . This is just off the charts. This is the Left, and they are so desperate to take over the United States.” (more…)