Latest Posts

Dow 5,000-Big One Starts in 2017-Charles Nenner

By Greg Hunter’s USAWatchdog.com (Early Sunday release)

By Greg Hunter’s USAWatchdog.com (Early Sunday release)

Charles Nenner, renowned financial and geopolitical analyst, says a major top in the stock market has been made, and it’s downhill from here. Nenner explains, “I still think big up moves should be used to sell equities. We are going slowly to a major sell-off. I still look for Dow Jones 5,000. I think the second half of 2016 is going to be a bad situation for stocks, but it’s not going to be the big one. The big one will start the third quarter of 2017 ending in 2020 or 2021.

Reporting on Trump Continues to be Unfair, Economy Getting Worse and South China Sea War Drums

By Greg Hunter’s USAWatchdog.com (6.3.16 WNW 240)

By Greg Hunter’s USAWatchdog.com (6.3.16 WNW 240)

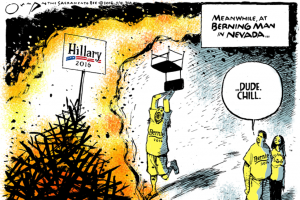

It was trash Trump week as far as the mainstream media (MSM) is concerned. It covered the Trump University lawsuit wall to wall but not a peep about the ongoing criminal investigation on Hillary Clinton and her unprotected private server. One of the big stories ignored this week by the MSM is former Bill Clinton advisor and pollster Doug Schoen penning a Wall Street Journal Op-Ed piece titled “Clinton Might not be the Nominee.” The title says it all, and yet the MSM ignored this huge red flag raised by a top Democratic insider about Hillary Clinton’s viability as a Presidential candidate for the Democratic Party.

Housing Market Hyper-Bubble-Fabian Calvo

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Real estate expert Fabian Calvo says cheap money flooding into the housing market means we are nearing the end of the road for the current housing boom. Calvo explains, “What they have come up with now, through the Obama Administration and many other projects, is they have these down payment assistance programs, which is the federal government giving money to these local agencies. So, in essence, it is a no-money-down loan to fuel this housing bubble, which is really starting to verge on a ‘hyper-bubble’ like we see in the stock market today. It’s amazing to see what is happening and see it all repeat again. It’s going to spill over into this election year, and we will continue to see prices go up. We have these cheap interest rates and cheap money that has no value that is creating this artificial boom. . . . We are at the last and final stage of this current housing cycle, and that’s where the prices will take off exponentially as will the access to cheap money.”

No Stopping Mother of all Collapses-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Trader/analyst Gregory Mannarino says you better be protecting yourself for what is coming in the financial markets. Mannarino explains, “It’s just a matter of time. Who knows when this actually rolls over–days, hours, months, who knows? . . . . There is no stopping it. All they are attempting to do is sustain it a little bit longer, and it’s only going to make this worse. The whole correction to fair value is going to seem like the mother of all collapses. It’s not a collapse in that sense. It is a correction to fair value because everything is just out of the realm of reality. There is no price discovery mechanism on anything—anything.”

Clinton Email Trouble Deepens, Bill Gross Economic Warning, Bathroom Gender Endgame

By Greg Hunter’s USAWatchdog.com (WNW 239 5.27.16)

By Greg Hunter’s USAWatchdog.com (WNW 239 5.27.16)

A new report by the Inspector General (IG) of the State Department puts Hillary Clinton in even deeper trouble over her unprotected email server that was installed in the bathroom of her home. The mainstream press finally picked up this story, even though it has largely ignored this latest Clinton scandal. The IG report says that Clinton broke the rules when she installed the private server without permission. The report also claims Ms. Clinton disregarded security policy with her private server. The Clinton camp says her use of a personal email account “was not unique,” but others criticized Clinton for endangering national security. (more…)

Criminal Bankers Threaten Entire World Economy-Helen Chaitman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Helen Davis Chaitman was the lead attorney representing the victims of the $65 billion Bernie Madoff scam. Madoff had help form JP Morgan Chase Bank, and what she found out was stunning. Chaitman explains, “JP Morgan Chase was the subject of a criminal complaint . . . it was charged with a criminal violation of the Bank Secrecy Act, which is a felony violation. JP Morgan Chase disgorged a small percentage of the profits it made on the Madoff relationship, and the government called it quits. Nobody was fired. Nobody disgorged bonuses, they just went on doing other crimes.”

All Electronic Assets Wiped Out in Fall Crash

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial analyst Bix Weir has laid out a timeline for the next financial collapse that he says is underway. Bix explains, “It’s happening now, and it has been happening since the beginning of the year. Some of the big things on the time line and one of the bigger things to watch is the Deutsche Bank (DB) implosion. That’s going to be gigantic because Deutsche Bank is the largest derivative holder in the world. Their stock is plummeting, and they are begging for tier 1 capital. It’s all happening right now. The question is what is the day that Deutsche Bank throws up its arms and says we’re insolvent? We are many times insolvent, and that would just destroy the European markets. It will also destroy the U.S. markets because our biggest banks are invested in the sovereign debt of European countries. (more…)

Saudi Financial Trouble Means US Financial Trouble, Fed Rate Hike Fake-Out, Bernie Beats Clinton-Again

By Greg Hunter’s USAWatchdog.com 5.20.16 (WNW 238)

By Greg Hunter’s USAWatchdog.com 5.20.16 (WNW 238)

Saudi Arabia is in deep financial trouble, and that spells financial trouble for the U.S. Let’s connect the dots. Shall we? The Senate just passed a bill that releases 28 secret pages from the 9/11 Report, and it also allows the families sue the Kingdom if it was involved in the attack. Saudi has threatened to dump U.S. assets if this becomes law. Some people say they would never do that because it would hurt them. I say, they may be forced to sell U.S. Treasuries and other assets because they need the money. This is against the backdrop of reports of Saudi Arabia paying workers and contractors with IOUs and mass layoffs in the Kingdom. No wonder why Moody’s just downgraded Saudi debt. This week, we also find out how much U.S. debt Saudi owns. (more…)

Global Elite Making Preparations for Post-Dollar World-Rob Kirby

By Greg Hunter’s USAWatchdog.com

Macroeconomic analyst Rob Kirby says his rich clients around the planet are bracing for an inevitable economic calamity. Kirby explains, “The people I know, that I would say are at the higher level of the food chain in the global world of finance, are hunkered down and making very serious preparations. What I see on a macro level is people acting like squirrels preparing for winter. They are burying nuts and gathering as much physical precious metals as they can. They are making preparations for a post-dollar world in terms of world reserve currency.”

Multiple Collapse Triggers Everywhere-V the Guerilla Economist

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Greg Hunter’s USAWatchdog.com (Early Sunday Release)

“V” the “Guerilla Economist” fears another global financial collapse “every day and every night.” “V” explains, “Economically speaking . . . What I see is it’s not one event. There are multiple triggers everywhere. If Deutsche Bank goes belly up tonight . . . that could send a cascade of bank failures throughout the euro zone, which will blow back right here through London to New York, and we will be in the absolute crap storm. We will be in the middle of it. It could happen at any time. If the Saudis decide to go nuts and decide to dump $750 billion . . . if they start dumping U.S. Treasuries, it can cause a run on the bond market. It could cause a massive fissure and a massive blow back. (more…)

Global War Tensions Rise, Economy Getting Worse and MSM Totally Unfair to Trump

Greg Hunter USAWatchdog.com

Greg Hunter USAWatchdog.com

Weekly News Wrap-Up 5.13.16 (WNW 237)

There was a new missile defense system installed in Romania. The U.S. says it is to protect Europe from an attack from a “rogue state.” Russia says this new missile defense site is a “direct threat to global and regional security.” Russia also says this is a “destructive action.” One Russian commentator said the missile deployment “. . . might even accelerate the slippery slope to nuclear war in a crisis.”

Trump is Free to Throw Mud on Clinton-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former Bush Administration (41) Assistant Secretary of Housing, Catherine Austin Fitts, says this presidential election will be most painful for Hillary Clinton. Fitts explains, “Here’s the thing, Clinton has never had to answer for the real deal issues and dirt on the Clintons. Here’s what’s interesting. One of the reasons the Clintons never had to answer is so much of it was done with the Bush family and the Republican establishment. They were really partners in many of the things they did. Before the campaign, Roger Stone came out with a book on the Bushes and a book on the Clintons. It was sort of a compendium on all the real deal dirt. That’s now in the body politic. The second thing we see is George H.W. Bush, W. Bush and Jeb Bush all come out and say they are not going to back Trump. That means Trump is free to throw the mud, and it will hit the Clintons, but it will splatter all over the Bushes. Now, Trump is free to go.”

Silent Coup Beginning to Overtake America Now-Larry Nichols

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Former Clinton insider Larry Nichols has worked with, and now against, the Clintons. Nichols has some of the top political and financial connections on the planet. Nichols hopes the public is finally realizing the enormous power struggle going on. Nichols explains, “There is no two-party system in the United States of America. Let’s get that straight. There is no two-party system, there is one. Part of it is a red team and part of it is a blue team. You think you have a choice, but as you know you only have a choice between the two they give you to vote for, but here comes Trump. Trump doesn’t need their money . . . he will bust up the system, and he will not only bust up the system for the Republican Party, but he will bust up the system (for both parties). So, there are many establishment Republicans that have said they would rather vote for Hillary than Trump. . . . They must maintain status quo of the system for these power elite people to stay where they want to be.”

Most Dangerous Stock Market in History-Michael Pento

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager and financial expert Michael Pento says every corner of the globe is in economic trouble. Pento contends, “I think we are going to have a global synchronized collapse amongst the developed world economies: Europe, Japan, the United States and China, and you should be hedging against this market. Don’t forget, we have the most overvalued, most dangerous stock market in the history of the world. . . . Record valuations sit on top of an unprecedented earnings and revenue recession. The only thing we have left is the promise of ZIRP, QE and negative interest rates that don’t work. All they do is inflate asset prices. You should be short the market, and you should be long precious metals.”

Very Big Correction for All Markets Coming-Alasdair Macleod

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Financial expert Alasdair Macleod says the most important economic news concerns the U.S. dollar. Macleod explains, “I think the most important point is actually the dollar has turned. The panic move into the dollar by miners and producers of raw material . . . was driving the dollar up. That has now ceased. China has now started buying those raw materials, base metals, oil and so on and so forth. So, the result is the commodity crisis is over. That, actually, is the biggest driver of the dollar, which is pushing it down.”