Latest Posts

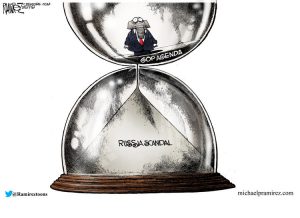

Trump Stops Syrian War, Mueller Witch Hunt Continues, Bankers Keep Cheating

By Greg Hunter’s USAWatchdog.com (WNW 293 7.21.17)

By Greg Hunter’s USAWatchdog.com (WNW 293 7.21.17)

Did President Donald Trump just signal an end to the Syrian civil war? President Trump just announced he was ending a covert CIA program to arm the so-called rebels. It was ISIS and al Qaeda we were supporting because the Free Syrian Army has long been dismantled. Is this the deal that Trump was cutting in his more than two hour meeting at the G-20? The Syrian war has taken the lives of nearly 500,000 people and displaced millions more.

We Are Now into Controlled Demolition-Catherine Austin Fitts

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Renowned financial expert Catherine Austin Fitts warns there is not much time left for the current system. Fitts contends, “We have built an infrastructure that doesn’t make economic sense, and we are going to have to change. What’s happening in state and local budgets is the same thing that is happening in health care. It’s the same thing happening in all these different areas, which is we have engineered government investment to prop up the stock market. . . . Washington, D.C., is basically run for the political campaign contributions generated from capital gains in the stock market. The problem is, to get that rise in the equity markets, we’ve ended up pumping out enormous amounts of government debt and government money that has a negative return for taxpayers. It’s not sustainable, and the game is up. . . . I’ve been telling you for 15 years we were going to have a slow burn. I am telling you that’s over, and we are now into controlled demolition.”

Biggest Fed Flip Flop in History-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Analyst/trader Gregory Mannarino says the Federal Reserve just did an about-face on raising interest rates in a matter of weeks. Mannarino contends, “This is incredible and hard to get my head around. This has got to be the flip-flop of all flip-flops. At the last FOMC meeting, Janet Yellen was practically pounding the table talking about how they were going to be continuing to raise rates, that they are going to start unloading their balance sheet here, and then she does an absolute 180. I am sitting there in real time watching it (this past week). My face dropped, and the moment I heard this, I started buying everything I could. . . . I thought this is it. The market is going to keep going higher. . . . The Federal Reserve has created a freaking monster. These distortions are now going to get much worse because Janet Yellen has given these markets the green light to go record up, record up and record up.”

Trump Jr. Treason – NOT, Russian Lawyer Worked for Democrats, Fed Rate Update

By Greg Hunter’s USAWatchdog.com (WNW 292 7.14.17)

By Greg Hunter’s USAWatchdog.com (WNW 292 7.14.17)

There is still no there there with the Russian collusion story in its latest version featuring Donald Trump Jr. This looks more like an episode of “Punk’d,” but there is no crime and no treason according to renowned lawyer Alan Dershowitz. What this really is all about is a fight between good and evil. It’s that simple. The Deep State and the MSM are doing everything they can to destroy Trump and his team. This is why President Trump held a prayer meeting at the White House where ministers laid hands on him in a prayer circle.

Bitcoin Civil War Coming Soon-Kevin Lawton

By Greg Hunter’s USAWatchdog.com

Keven Lawton is a tech entrepreneur with 10 startups under his belt. He is also an expert in crypto currencies and sees a Bitcoin civil war coming soon. Lawton says, “In Bitcoin, there are huge scalability issues in terms of transaction speed. It’s been ongoing for years now. There is a set of ideas from the developers on how to fix this, and there is a set of ideas from the miners and payment transactors on how to go about fixing this. . . . They are sort of like two camps, and they have really split off. The developers have a proposal . . . and that will probably roll out around August 1st. Then, on the other side, big money people and payment processors and miners . . . they have their own proposal, and they want to do more than the developers want to do.”

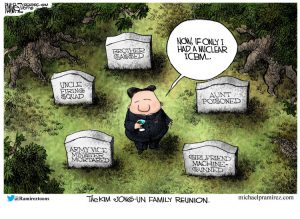

North Korea ICBM Danger, Economic Update, DNC Server Still Hidden

By Greg Hunter’s USAWatchdog.com (WNW291 7.7.17)

By Greg Hunter’s USAWatchdog.com (WNW291 7.7.17)

North Korea celebrated the Fourth of July with a bang by successfully launching a brand new ICBM. An emergency meeting was called at the UN, and the President said it was “dangerous” and would have to be “dealt with.”

CNN Proven Very Fake News, Dollar Tanking, Yellowstone Could Blow

By Greg Hunter’s USAWatchdog.com (WNW 290 6.30.17)

By Greg Hunter’s USAWatchdog.com (WNW 290 6.30.17)

A CNN producer and a top on air talent were both caught on hidden camera admitting the so-called Trump collusion story was a “nothing burger,” “pretty much BS” and was being followed “because of ratings.” Project VERITAS produced the videos that aired just after CNN was forced to retract and take down a false story on a Trump supporter and friend. A $100 million lawsuit was reportedly threatened, and the story was quickly taken down. Apologies were made by CNN after some involved with the story were forced to quit. It appears none of the bosses in charge took any of the blame.

Consequence of Rigged Markets is Currency Crisis – James Howard Kunstler

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Author/journalist James Howard Kunstler has been in the writing business for decades and has never seen the geopolitical and economic landscape in America look like it does today. Kunstler explains, “I have never lived through a time, and it’s obvious I have lived a long time . . . in American history that is as crazy as this one. The part that is the most disturbing is the people who used to be sane have now completely gone off the rails. I am speaking of the Democratic Party. The nonsense that is coming out of that wing of our politics has really become a reality optional political party.”

War & Financial Calamity Two Biggest Trends – Gerald Celente

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Top trends forecaster Gerald Celente thinks of all the things he studies, war and financial calamity are the two biggest trends he sees. The big game changer in the geopolitical global landscape is war coming from the Middle East. Celente explains, “It’s the war against Iran. That’s the way we see it, and we recently did a trend alert on it. The Iran war will be World War III. It will also probably be the war to end all wars and a good part of civilization if it happens. These are the Persians, and they are not going anywhere.”

Middle East Dog Fight, Economic Update Not Good, 6 Million Vote Illegally

By Greg Hunter’s USAWatchdog.com (WNW 289 6.23.17)

By Greg Hunter’s USAWatchdog.com (WNW 289 6.23.17)

The Middle East had near dogfight aerial combat in the skies over Syria. The U.S. shot down a Syrian fighter jet and an Iranian drone. Russia immediately halted cooperation with the U.S. in Syria, and warned it would “intercept” any aircraft in areas it controlled. Russia also charged the U.S. that America was “supporting terrorists.” One former Obama Administration insider says, “The risk of a big war is rising.”

Fed Trying to Cripple Trump Economy-Danielle DiMartino Booth

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial expert and former top Federal Reserve insider Danielle DiMartino Booth says the latest Fed rate hike is nothing less than an attempt to make life worse for President Trump. DiMartino Booth explains, “They are trying to do the opposite of what they did a year ago because the people who occupy the White House have changed. That’s the only feasible answer I can come up with to explain the Fed tightening into a weakening economy. Their own metrics don’t lie. Nonfarm payroll growth has slowed appreciably over the last 12 months, and their favorite inflation metric is back below 2%. These are the rules they have made up, not me. They (the Fed) are making policies against their own rules, and there has to be a reason for it.”

Bitcoin is High Reward & High Risk – Warren Pollock

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Geopolitical and financial analyst Warren Pollock says you should study up on Bitcoin before you buy it. Pollock says, Bitcoin (and crypto currencies in general) carries “high reward, but also some very high risk.” Pollock explains, “First of all, Bitcoin and these other crypto currencies are not currencies. Most of all, they are not efficient ways of having transactional exchanges between people. They just don’t work the same way the credit card network does or the check writing does. In fact, the speed in which Bitcoin can clear a transaction is downright pathetic. . . . I was able to obtain Bitcoin transaction speed at about 6.9 transactions per second. That’s what I evaluate the network capacity to be. . . . Right now, in America, you take your Visa card and up to 50,000 people can transact concurrently per second. So, there is a tremendous lack of horsepower in Bitcoin.”

MSM Propaganda Cause Left Hate, Trump Obstruction – Not, Obama Administration Treason

By Greg Hunter’s USAWatchdog.com (WNW 288 6.16.17)

By Greg Hunter’s USAWatchdog.com (WNW 288 6.16.17)

You want to know why the “Left” hates Donald Trump? Look no further than the lies, false narratives and fake news of the mainstream media (MSM). Several U.S. Congressmen were shot while practicing for a charity baseball game in Washington, D.C. The lone shooter is a self-described Trump hater and volunteered for the Bernie Sanders campaign. Looks like the propaganda of the MSM worked on the extreme in the thought shaping in this case.

The Political Pope Francis – Man Above God – George Neumayr

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Best-selling author George Neumayr’s new book is called “The Political Pope.” Neumayr reveals, “How Pope Francis is delighting the liberal left and abandoning conservatives.” Neumayr explains, “The irony with this Pope is that he doesn’t particularly like Catholics. He views devout Catholics with a certain amount of distain, and that’s why the left likes him so much. He see’s Catholics in the same way they do. They see them as ridged and pharisaical, and he’s used those same terms to describe them. In many ways, he is adopting some of the anti-Catholic invective that is popular on the fashionable left, which has been for many decades anti-Catholic. With the Pope on the chair of Saint Peter, who is criticizing Catholics saying they are too conservative . . . the media is eating up this Pope.”

Market Crash and Civil War Possible-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Analyst/trader Gregory Mannarino says do not be fooled by the stock markets at or near all-time highs. Friday, the tech heavy NASDAQ suffered a massive selloff late in the day after hitting all-time highs. What happened? Mannarino explains, “There is no doubt that we are in financial fantasyland. It is epic. So, have we just witnessed the bursting of this bubble? It is very possible, and the reason why is because it came out of nowhere. It wasn’t driven by a geopolitical event. It wasn’t driven by a downgrade. It wasn’t driven by anything, it just happened. . . . There is going to be a moment of reckoning. If this is real. If this is an actual bursting of a bubble here, the tech bubble, we might get a follow through on Monday or we might get a bounce, and that will lead to a follow through. . . . I am telling people to watch out because the fact this came out of nowhere and driven by nothing is a big tell.”