Latest Posts

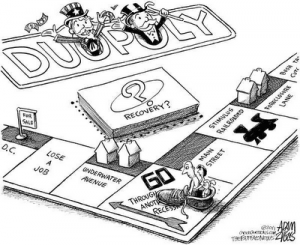

Mainstream Media Spins Real Estate Recovery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Just about everywhere you turned yesterday, the mainstream media (MSM) was talking up the good news in the latest Case-Shiller Home Price Index report. For example, the online version of USA Today had a headline that read “Spring buying boosts home prices, market still sluggish.” The first line of the story said, “Prices rose 0.9% in July over June, marking the fourth-consecutive month of increases for the Standard & Poor’s Case-Shiller index released Tuesday.” (more…)

It’s Much Worse than 2008

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

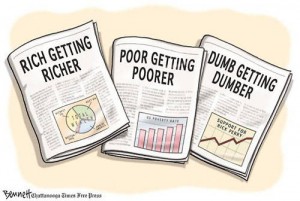

I keep hearing the so-called experts say how much better shape the banks are in now than in the last financial meltdown of 2008. To that, I say horse hooey! Any expert worth his salt knows that nothing has been fixed in the financial system. The problems were papered over with fiat currency and the proverbial can kicked down the road—ting ting ting. (more…)

A Global Meltdown

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

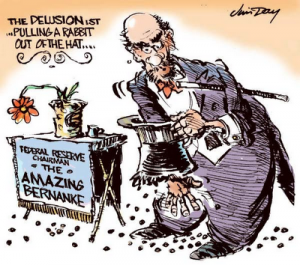

The “you know what” hit the fan today with sharp selloffs of just about everything. The Dow was off nearly 400 points–ouch! So much for the so-called “recovery.” Gold made a significant comeback after being down nearly $80 at one point, but it still took one on the chin. Yesterday, Fed Chief Ben Bernanke admitted that the world economy was in the tank and headed lower when he said there were “. . . significant downside risks to the economic outlook, including strains in global financial markets.” (more…)

Will China Stop Buying U.S. Debt?

A few weeks ago, the Telegraph UK did a story about the sharp drop in foreign holdings of U.S. Treasuries. One of the big buyers of American debt is, of course, China. There are those that think China is forced to buy our debt otherwise its economy will collapse. Until the Treasury releases what is called “TIC” data (Treasury International Capital) in November, we really will not know what is going on. (more…)

Dangerous New Phase

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The head of the International Monetary Fund, Christine Largarde, said Friday the world economy is entering a “dangerous new phase.” Lagarde is referring to a debt bubble, the likes of which the planet has never seen before, and the possibility that it could all unravel at any moment. Uncertainty over the debt crisis in Europe is what caused the Dow to crash more than 300 points at the end of last week. What is Lagarde going to do about the debt problem? (more…)

Fix the Banks!

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

If there is one central theme to the ongoing financial crisis we face, it is an insolvent banking system. It is so bad that the accounting rules were changed (after the financial meltdown in 2008) to allow banks to value assets on their books at whatever they think they will fetch far into the future. So, the billions of dollars of underwater mortgage-backed securities and real estate sitting on the balance sheet is held at imaginary values to make many banks look solvent when, in fact, they are not. (more…)

Where Are We?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Yesterday, the Dow was up more than 300 points, and gold hit another all-time high before dropping nearly $100 an ounce. You would think the stock market was back and the gold trade was over. Wall Street is excited about recent bad economic news that just may force Fed Chief Ben Bernanke to start a third round of quantitative easing (QE3). I hate to break it to Wall Street, but QE3 is already underway in the form of 2 years of guaranteed near 0% interest rates. (more…)

Good News in Libya Won’t Last

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It looks like the end of power for tyrant Muammar Gaddafi. He’s been in power 40 years, but what will take his place? Remember when stories broke out a few months ago about Libyan rebel al-Qaeda links? It is a fact that was reported in one of many publications such as The Telegraph back in March. The story headline read “Libyan rebel commander admits his fighters have al-Qaeda links.” (more…)

Here We Go Again!

By Greg Hunter’s USAWatchdog.com

It was another 400 point loss on the Dow today. Manufacturing is contracting according to the latest reports, and Europe is in very big trouble with sovereign debt (especially with Spain and Italy). If the Euro falls apart, then the dollar will be the big near term beneficiary. So, the buck could actually strengthen for a short while because it would be the prettiest ugly girl in the currency room. If stocks (especially the banks) keep getting pounded and the economy keeps sinking, then the fed will be forced to act or let the economy and the market fall off a cliff. (more…)

Brace for Impact

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

“Brace for Impact.” I have thought about this economic collapse title for months. I held onto it and figured I would know when the right time was to put it out there. Today is the day. Watching mainstream media (MSM) this weekend, you would think a one notch downgrade to America’s debt doesn’t really matter. For example, former CNBC anchor Erin Burnett said Friday night on CNN the downgrade was “already priced into the market.” The panel spoke as if the first U.S. debt downgrade in history was no big deal. To that I say, positively absurd! (more…)

Deficit Will Grow While Economy Shrinks

I appreciate what the Tea Party and folks like Congressman Paul Ryan are trying to do. Mr. Ryan, who is the House Budget Committee Chairman, said when the debt deal passed, “This is a down payment on the problem and it’s a good step in the right direction.” Ryan went on to make what is probably the most important point, “And it is a huge cultural change to this institution.” Amen to that Mr. Congressman, but this debt reduction bill is like trying to bail water out of a battleship with a thimble. (more…)

You Cannot Doubt the Gold Bull Market

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. (more…)

There have been a lot of naysayers when it comes to the gold bull market we are in right now. I don’t see how anyone can deny it exists, but many who missed it, now say gold is in a bubble. I just want to hold my sides and laugh because the facts, and experts who predicted this years ago, say just the opposite. It is hard for many to see this, but gold is really just getting started. To equal the previous 1980 high of $850 an ounce, gold would have to be more than $8,000 an ounce in today’s money. (more…)

Bad Unemployment Report Tangles Debt Deal

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

If the debt ceiling deal wasn’t complicated enough, Friday’s terrible unemployment report poured sand into the gears that ground negotiations to a halt. Nothing came out of Sunday’s meeting of Congressional leaders at the White House on resolving America’s debt crisis. (more…)

The People Fiddle as the Country Burns

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Thank goodness the Casey Anthony case is over! The jury thinks she is not guilty of murder. I don’t know if they got right or wrong, but I do know many dollars and much air time was devoted to a story that will have zero effect on the lives of 99.999% of Americans. I think the discovery of a walking, talking Martian would have gotten about the same attention. (more…)

Print More Money

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The second round of quantitative easing (QE2) is scheduled to end June 30, and already there are calls for more financial stimulus to keep the economy from falling off a cliff. The latest call came from Larry Summers, former head of the Obama Administration’s financial team. In an Op-Ed piece that ran on Reuters last Sunday, Summers pitched the idea of a $200 billion cut in the payroll tax. (more…)