Latest Posts

Egypt Will Explode

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

“Egypt will explode.” That was the reaction on twitter from Mohamed ElBaradei to Hosni Mubarak’s announcement not to resign the Presidency of Egypt. ElBaradei is a former Director General of the International Atomic Energy Agency and Nobel Peace Prize winner. Now, he has emerged as a leader of the opposition movement. (more…)

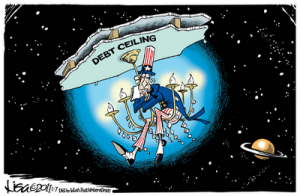

The Worst 4 Letter Word of All–Debt

You can write volumes on what is actually wrong with the economy. We have record foreclosures, the FDIC closing banks every weekend, high unemployment, enormous deficits, food banks running out of money, sour mortgage-backed securities and the list goes on and on. You could tie almost every financial problem together with one little ugly four letter word—DEBT. Even our money is debt because, for the most part, it is loaned into existence. (more…)

You can write volumes on what is actually wrong with the economy. We have record foreclosures, the FDIC closing banks every weekend, high unemployment, enormous deficits, food banks running out of money, sour mortgage-backed securities and the list goes on and on. You could tie almost every financial problem together with one little ugly four letter word—DEBT. Even our money is debt because, for the most part, it is loaned into existence. (more…)

9% Unemployment Rate is a Statistical Lie

Greg Hunter’s USAWatchdog.com (updated)

Greg Hunter’s USAWatchdog.com (updated)

The Bureau of Labor Statistics (BLS) released the latest unemployment figures last Friday. There was a stunning drop to 9% from 9.4%. How did that happen? Is the economy really getting better or is the government up to its old statistical tricks. According to the mainstream media, the economy is getting better and the so-called recovery is alive and well. (more…)

Egypt Diverts Media Attention from U.S. Economy

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The revolution in Egypt has been going on for nearly two weeks. It is intensifying. There are reports of gunfire, beatings of foreign journalists and looting. It is a riveting story because so much is at stake for America. However, the Egypt saga is sucking up resources and attention away from other stories that are also very important for America. (more…)

In Egypt the Earth Shifts

I was watching Egyptian news coverage of the protests on NBC last night, and I was amazed by the spin the Peacock Network took. It was being reported as something positive–as if the mass release of prisoners by angry mobs (a few days ago) was a good thing.

I was watching Egyptian news coverage of the protests on NBC last night, and I was amazed by the spin the Peacock Network took. It was being reported as something positive–as if the mass release of prisoners by angry mobs (a few days ago) was a good thing.

They didn’t bring that up while I was watching the 2011 Egyptian protests, but correspondent Richard Engel did a stand-up in a crowd that felt more like Mardi Gras than revolution. Here’s more of NBC’s coverage on the web, “In Washington, President Barack Obama said he spoke with Mubarak after the speech, and the Egyptian leader “recognizes that the status quo is not sustainable and a change must take place.” (more…)

Keep Your Eye on Middle East Wild Card

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Just a few weeks ago, an uprising toppled a little known Tunisian leader (President Zine al-Abidine Ben Ali.) Tunisia is due west of Egypt, separated only by Libya. About the only thing that seemed newsworthy was the family reportedly took flight with a ton and a half of gold. (more…)

State of Denial

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Barack Obama addressed the country for the third State of the Union address of his Presidency this week. In broad terms, he talked mostly about innovation, education and jobs. To be fair, he also briefly touched on the deficit, the two wars we are fighting and unity. But because so much emphasis was put on education, it sounded more like an address to a local PTA (more…)

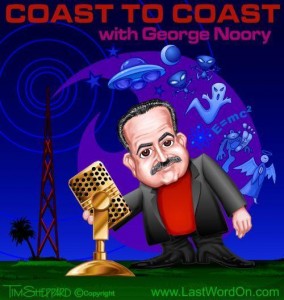

Greg Hunter on Coast to Coast AM!

I was on Coast to Coast AM early Wednesday morning.

I was on Coast to Coast AM early Wednesday morning.

Coast to Coast AM is a nation-wide radio show with a network of more than 500 radio stations.

I was on the first hour of the show (1am EST) to talk about the “REAL” State of the Union.

Check out the Coast to Coast website here: http://www.coasttocoastam.com/

New USAWatchdog.com visitors from Coast to Coast AM – welcome to USAWatchdog! You are always welcome here. Please leave a question or comment on what you think the “Real” State of the Union is in your neck of the woods. I guarantee I will read and answer everyone. If you comment, make sure to include your city and state. Please try to get to the point, and keep it sharp and short. (But I won’t cut anyone off if they don’t.)

Here is audio from the C2C AM show from a reader named Brent. He wrote me and said, “I happened to miss the show last night but I really wanted to hear it and I found it on youtube. Here are the links to anyone else who missed it.” :

Part 1: http://www.youtube.com/watch?v=4YsCnyUlVWI

Part 2: http://www.youtube.com/watch?v=zZ11s9L5F-4

Part 3: http://www.youtube.com/watch?v=pSECuqbkLTk

Also, please feel free to browse our site and read through some of the past few months most popular posts:

- How Do I Buy Gold and Silver?

- Headlines Confirming Troubled Times Are Here

- The Most Predictable Financial Calamity in History

- Bad Real Estate News Ignored to Spin Bright Future

- New Year Predictions and Comments

–Greg Hunter–

The Most Predictable Financial Calamity in History

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In November 2010, the Federal Reserve announced a second round of economic stimulus commonly referred to as Quantitative Easing (QE2). The reason, according to the Fed, was “progress toward its objectives has been disappointingly slow.” So, to try and turn the economy around, the Fed said, “. . . the Committee intends to purchase a further $600 billion of longer-term Treasury securities (more…)

Housing Shows There Is No Recovery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Housing starts are a tried and true barometer of business activity. If there was a real economic recovery going on, housing starts would be, at the very least, edging up. Please keep in mind the government is providing some of the lowest mortgage rates in a generation. A 30-year mortgage is around 4.75%. This week, the Commerce Department reported housing starts were down 4.3% last month. (more…)

Most U.S. Cities and States Float in a Sea of Red Ink

Nearly every state in the Union and nearly every large city are facing ballooning budgets and shrinking tax revenue (confiscation). Some, such as Illinois and California, are boarding on insolvency and need to fill budget holes that are tens of billions of dollars. Tax receipts everywhere are plummeting because of the high unemployment rate that, in reality, is above 22%. On top of that, foreclosures hit another record nationwide in 2010 and are expected to set yet another one this year.

Nearly every state in the Union and nearly every large city are facing ballooning budgets and shrinking tax revenue (confiscation). Some, such as Illinois and California, are boarding on insolvency and need to fill budget holes that are tens of billions of dollars. Tax receipts everywhere are plummeting because of the high unemployment rate that, in reality, is above 22%. On top of that, foreclosures hit another record nationwide in 2010 and are expected to set yet another one this year.

Inflation Is Here

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

For months now, the Federal Reserve has been worried about inflation being too low. So low, that the Fed claims it is unhealthy to the U.S. economy. When it announced its second wave of money printing (QE2) in early November 2010, the Fed said, “Longer-term inflation expectations have remained stable, but measures of underlying inflation have trended lower in recent quarters. . . . (more…)

Bad Real Estate News Ignored to Spin Bright Future

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was shocked to see this headline from an Associated Press story yesterday, “Economists project home sales, construction to rise sharply in 2011 from extreme lows of 2010.” I was dumbfounded by the title of the article and even more taken back when I read the story which said, “The forecast delivered at the International Builders’ Show in Orlando sees U.S. economic growth sharply lifting home sales and residential construction over the next two years, but from near-historic lows posted last year. “ (more…)

Will Raising the Debt Ceiling Bail Out the Banks, Again?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Just after the first of the year, the Chairman of the U.S. Council of Economic Advisers, Austan Goolsbee, emphatically pushed for Congress to raise the debt ceiling. Goolsbee said on the ABC Sunday talk show, “This Week,” if it was not raised, the “impact on the economy would be catastrophic . . . “If we get to the point where we damage the full faith and credit of the United States, that would be the first default in history caused purely by insanity.” (more…)

Vitriol is a Veiled Attack on Free Speech

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com